Fast Details About Automobile Costs

Automobile customers can get some superb offers on new automobiles for the present mannequin yr. After the Federal Reserve pulled the lever on the primary rate of interest drop since March 2020, carmakers appeared desirous to rid their a number of extra inventory final month, and lenders started engaging customers with higher rate of interest provides. We’ve seen extra 0% financing offers than prior to now a number of years.

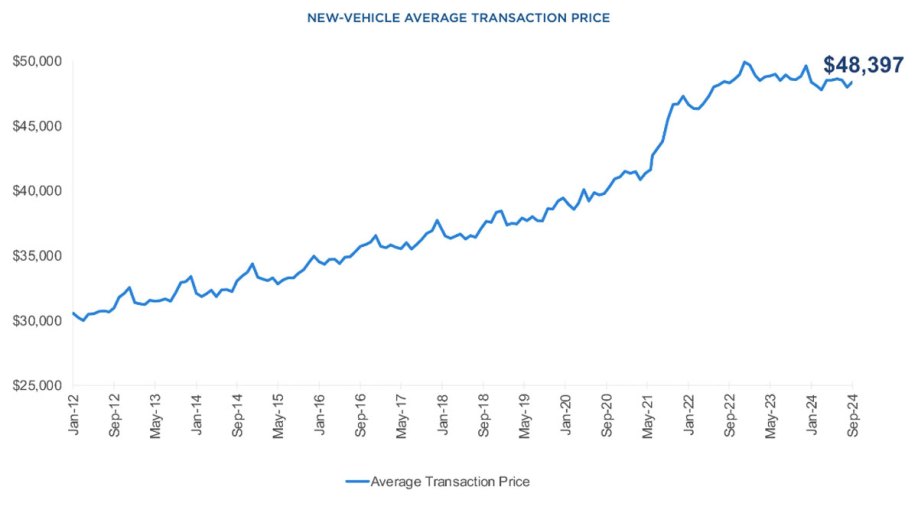

Lately, automobile customers have turn out to be accustomed to paying greater than the producer’s instructed retail value (MSRP). They watched automobile costs rise with no obvious finish in sight. At the same time as costs began to drop, they now seem caught in impartial. The state of affairs left many consumers scratching their heads, and the query our consultants hear most is, “When will new automobile costs drop?”

New automobile value inflation all however disappeared by the tip of final yr. Nonetheless, automobile costs have elevated dramatically prior to now three years. Learn on for steerage if you wish to buy a automobile. We offer the very best data from our consultants and dig deeper to reply issues about automobile costs.

New Automobile Costs Fluctuating

Kelley Blue Ebook knowledge present that common transaction costs had been $48,397 in September. Like a pingpong ball caught between two paddles, common transactions have volleyed between the present value and $47,400 since January.

“New-vehicle transaction costs proceed to be very regular this yr, and better incentive spending helps preserve gross sales quantity,” stated Cox Automotive Government Analyst Erin Keating. “We nonetheless imagine there’s potential for progress available in the market for the remainder of the yr, however with the uncertainty of a nationwide election across the nook and main climate occasions disrupting enterprise, possibly a sluggish, regular tempo is all we should always anticipate.”

This volume-weighted calculation displays all of the automobile market realities, together with high-volume automobiles like expensive pickup vehicles influencing the quantity. For instance, the report reveals that full-sized pickups posted a median transaction value of about $65,000.

Moreover, electrical automobiles posted common transaction costs of $56,351 in September. The nation’s largest electrical automobile (EV) vendor, Tesla, noticed its common transaction value decline to $58,212, in comparison with 59,138 in August. Nonetheless, Tesla costs are greater year-over-year by almost 13.6%. That’s probably as a result of its Cybertruck (with costs beginning at $82,235 with a vacation spot charge of $1,995) as a result of knowledge present its common costs are a lot greater at $116,706.

General, common transaction costs stay almost $11,000 greater than 5 years in the past, earlier than the COVID-19 pandemic. At the moment, common transaction costs for brand new automobiles had been $37,590.

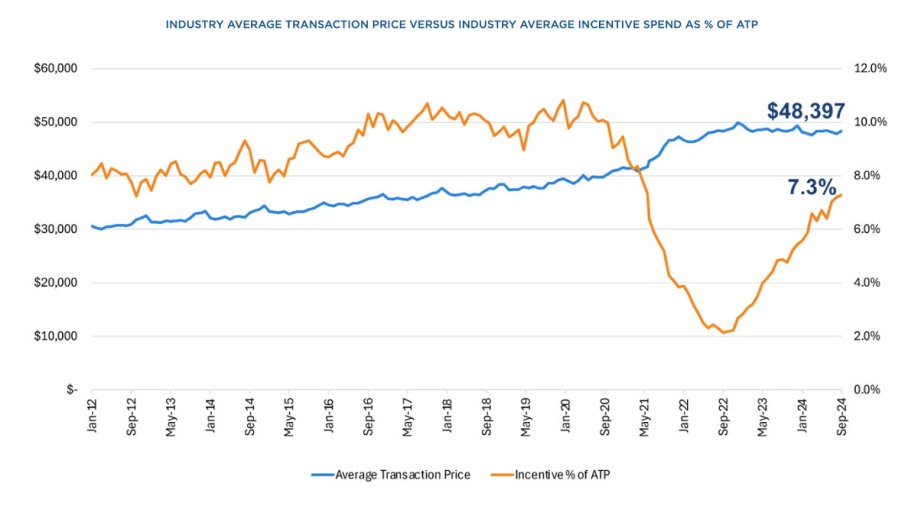

In September, producers piled on extra automobile incentives, a median of $3,522, to assist transfer 2024 fashions and make approach for 2025 fashions.

What Drives New Automobile Costs

- Stock availability

- Producer incentives

- Vendor reductions

- Commerce-in automobile worth

New Automobile Stock Replace

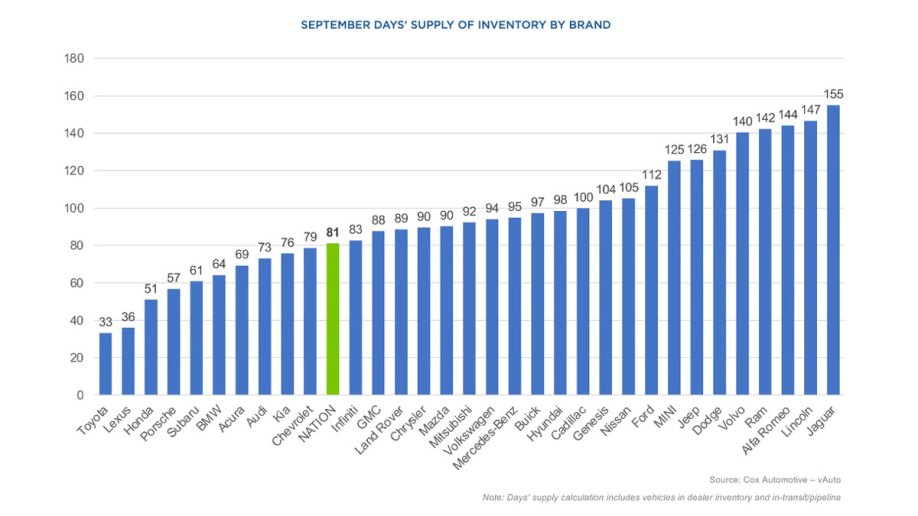

Regardless of back-to-back hurricanes, different volatility from port disruptions within the East and Gulf Coasts and manufacturing, and a cyber breach that shut down dealership computer systems, September stock knowledge seemed virtually steady. In accordance with the Cox Automotive vAuto Reside Market View, stock seemed about “regular” at 81 days. The final time we noticed that was in 2019.

Dealerships measure their inventory of latest automobiles to promote in a measurement referred to as “days of stock,” or how lengthy it might take them to promote out of latest automobiles at as we speak’s gross sales tempo if the automaker stopped constructing new ones.

About 37% of the automobiles in a sellers’ showroom are actually 2025 fashions. The opposite almost 60% of automobiles have to be bought earlier than the tip of the yr. Stellantis, the mother or father firm to the Alfa Romeo, Dodge, Chrysler, Jeep, and Ram manufacturers, continues to be coping with extra new automobile stock from 2023.

Stellantis CEO Carlos Tavares just lately reiterated his plan to see U.S. inventories dip beneath 350,000 earlier than the tip of the yr whereas on the Paris Auto Present. In accordance with the vAuto knowledge, Dodge and Ram stay oversupplied, with 131 and 142 days of stock, respectively.

Car Incentives Get a Bump

Carmakers boosted their incentives to lure patrons in August. In accordance with Kelley Blue Ebook’s analysts, carmakers spent 7.3% of the typical transaction value, or $3,522, on incentives meant to maneuver automobiles. That’s the very best quantity in over three years and about $75 greater than August. New EV incentives had been 12.3% of the typical transaction value, or about $6,900.

When automakers construct an oversupply of automobiles, they low cost the automobiles to get them off vendor heaps. For a number of years, carmakers and dealerships confirmed no glut of automobiles to promote and barely supplied reductions.

It’s a Purchaser’s Marketplace for New Vehicles

The brand new automobile panorama is a purchaser’s market. Customers heading out to buy a brand new automobile will discover greater incentives, and certified patrons with stellar credit score will uncover some first rate low-interest-rate provides and lease offers, particularly on electrical automobiles. We’ve additionally seen some dealerships providing further reductions to maneuver 2024 fashions because the inflow of 2025 fashions begins.

The variety of carmakers providing 0% financing and different offers is on the rise. For instance, certified automobile patrons with good credit score can safe 0% offers on a 2024 Nissan Pathfinder Platinum (beginning at $51,010) and a further $500 off for 36 months or a 2024 Kia EV6 (beginning at $43,975) for as much as 72 months.

You’ll want to store round to search out the very best deal on the automobile you wish to buy.

Store Round for the Finest Supply on Your Commerce-In

Commerce-in worth is one other issue driving automobile costs. An absence of used automobile inventory has stored costs greater, giving credence to the concept that shopping for a brand new automobile is cheaper than buying a current mannequin used one. Because of this, it’s a good time to commerce in your automobile.

Sellers worth your trade-in partly based mostly on what they want in inventory. Subsequently, they’re extra more likely to supply a superb deal to patrons on a automobile fewer persons are searching for presently. In different phrases, a automobile shopper buying and selling a 2018 Honda Civic for one thing else might be a lot happier with the trade-in appraisal than one with a 2021 Jeep Grand Cherokee.

Automobile patrons ought to put together to buy their trade-in round. It’s barely extra sophisticated to tug off, however promoting your outdated automobile to at least one dealership and shopping for your new automobile from a distinct one might make sense if the ultimate bill numbers work out in your favor. Use the Kelley Blue Ebook Instantaneous Money Supply software to buy your trade-in automobile at close by dealerships. Once you let the offers come to you, selecting the right trade-in supply in your state of affairs is simpler. Bear in mind, you possibly can at all times negotiate the supply, and pitting one supply towards the subsequent isn’t exceptional.

The Larger Prices of Automobile Insurance coverage

In accordance with the Bureau of Labor Statistics, automobile insurance coverage prices had been nonetheless excessive in September at about 16.3% over a yr earlier. Bankrate says automobile insurance coverage averages about $2,300 a yr for full protection. Earlier than you seal the deal and signal something for a brand new automobile, evaluate quotes for automobile insurance coverage.

What to Anticipate: Wanting Forward

In September, the Federal Reserve dropped its finest information all yr. The nation’s central financial institution lowered its key rate of interest by half a share level to curb an financial slowdown. Extra cuts may come.

Reduction may carry at the least a little bit cheer earlier than the tip of the yr for auto mortgage rates of interest. Fee cuts from the Federal Reserve take time to trickle via the financial system.

Cox Automotive Chief Economist Jonathan Smoke stated that even with a price minimize as we speak, “it’s not probably that auto mortgage charges will decline a lot earlier than yr’s finish.”

For customers, the typical month-to-month automobile fee has come down. Cox Automotive knowledge present that after peaking at $795 in December 2022, the typical American automobile fee remained regular for the final two months at about $740. Excessive rates of interest made up a few of that expense. The automobile mortgage rates of interest make it exhausting for a lot of shoppers to afford a automobile if they should finance the acquisition. In accordance with the latest Cox Automotive analysis, the everyday new automobile mortgage rate of interest was a median of 9.54% for brand new automobiles in September. For these shopping for used automobiles, charges had been 13.91%.

What to Do if You Want a Automobile Now?

For now, you possibly can both sit again and wait out the times for decrease rates of interest in your financed automobile. Or, when you desperately want a automobile now, store round and verify for producer offers like money again and 0.0% to low rate of interest finance provides. In the event you can wait, extra aid may come, particularly if the Fed cuts the speed additional.

Consumers searching for a used automobile ought to weigh prices rigorously if they need to finance proper now. In some instances, newer used automobiles value the identical as new ones. Additionally, you possibly can attempt to negotiate an ideal deal on a 2024 mannequin deal as a result of sellers wish to clear their heaps earlier than the tip of the yr.

Editor’s Observe: This text has been up to date for accuracy because it was initially printed. Sean Tucker contributed to this report.