With regards to being paid to your exhausting work, the sooner you will get your cash, the higher.

Nonetheless, it could generally be a trouble to go to the financial institution or to make use of your cellular banking app to money or deposit a verify each time you receives a commission. Direct deposit is the reply should you’re searching for a extra handy technique.

Direct deposit, a service typically provided by payroll providers, streamlines your paycheck course of, placing your hard-earned cash immediately into your checking account electronically. Let’s delve deeper into how direct deposit works and the way it can profit you.

What’s a direct deposit?

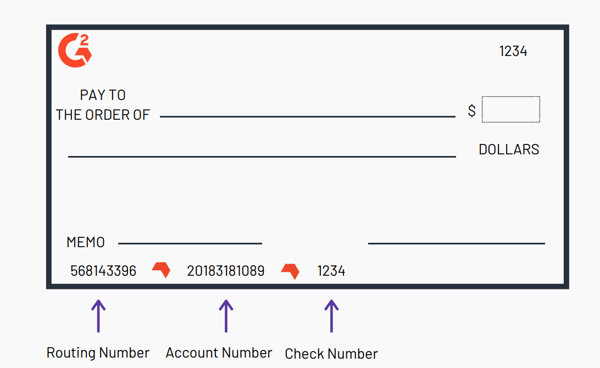

If you begin a brand new job, your employer offers you a direct deposit kind. You’ll must fill out this type together with your checking account quantity, routing quantity, kind of account (usually a checking account), financial institution title and tackle, and a voided verify.

Learn how to arrange direct deposit:

- Fill out your financial institution routing quantity

- Fill out your checking account quantity

- Specify the kind of account

- Fill out the financial institution’s title and tackle

- Embrace a voided verify

Your routing quantity is 9 digits and may be discovered within the lower-left nook of the entrance of the verify. Your checking account quantity is simply to the appropriate of this, additionally within the lower-left nook. Your checking or financial savings account will likely be the kind of account you select.

Some direct deposit slips might also ask to your social safety quantity and residential tackle, so be sure you have that info useful. As soon as the direct deposit kind is crammed out utterly, flip it in to your employer.

How does direct deposit work?

Direct deposit is an on-line cost course of which eliminates the necessity for bodily checks. It affords a safe and handy strategy to obtain your paycheck or different recurring funds immediately into your checking or financial savings account. Here is a breakdown of the way it works:

1. Organising direct deposit:

- You will present your employer (or different payer) together with your checking account info. This usually contains your routing quantity and account quantity, which may be discovered on a verify or your financial institution’s on-line portal.

- Some employers might supply on-line enrollment for direct deposit, whereas others would possibly require a paper kind.

2. Digital switch:

- Earlier than payday, your employer initiates the direct deposit course of. They ship a safe digital notification to their financial institution, which incorporates your banking info and the cost quantity.

- This notification travels by means of the Automated Clearing Home (ACH) community, a central system that facilitates digital financial institution transfers within the US.

- The ACH routes the knowledge to your financial institution.

3. Receiving the funds:

- Your financial institution receives the notification and verifies your account info.

- As soon as every little thing checks out, your financial institution robotically deposits the funds into your designated account on the scheduled day.

- You will usually obtain an alert out of your financial institution notifying you of the deposit.

How lengthy does a direct deposit take?

Curious when your first direct deposit will hit your account? Whereas organising direct deposit is a breeze, it’d take one to 2 pay cycles earlier than you see the cash mirrored in your stability.

It is because, in some circumstances, your employer would possibly subject a bodily verify in the course of the preliminary transition interval to make sure every little thing is ready up appropriately.

As soon as direct deposit is totally lively, the precise timing of your funds showing relies on your organization’s payroll schedule and software program. Some companies pay bi-weekly, whereas others go for weekly pay or a hard and fast schedule on the fifteenth and thirtieth.

To keep away from any surprises, it is best to verify together with your employer about their payroll administration schedule and when you’ll be able to anticipate your first direct deposit.

Advantages of direct deposit

Direct deposit affords a win-win state of affairs for each employers and staff. It eliminates the trouble of paper checks and supplies a safe, handy strategy to handle your funds. Here is how:

For workers:

- Computerized deposits: Say goodbye to ready for checks to reach or remembering to deposit them. Your paycheck robotically seems in your checking account on payday, prepared for instant use.

- Peace of thoughts: Direct deposit eliminates the danger of misplaced or stolen checks. Your cash goes straight to your safe checking account.

- Quicker entry: Not like paper checks that may take days to clear, direct deposits are usually obtainable instantly on payday, permitting you to entry your funds faster.

- Simplified document maintaining: Digital information of your paychecks are available in your financial institution statements, making budgeting and tax preparation simpler.

For employers:

- Value financial savings: Direct deposit eliminates the necessity for printing checks, shopping for envelopes, and postage, decreasing administrative prices related to payroll processing.

- Elevated effectivity: Automated deposits streamline the payroll course of, saving effort and time in comparison with dealing with paper checks.

- Lowered errors: Direct deposit eliminates the potential for errors related to writing and distributing bodily checks.

- Improved safety: There is no danger of misplaced or stolen checks, guaranteeing your staff obtain their pay securely.

It’s at all times finest to be direct

Whether or not you are receiving or issuing funds, switching to direct deposit can prevent time, cash, and peace of thoughts. Each in life and on the subject of your deposits, organising a direct deposit is simple, and very quickly, you’ll see your cost come by means of to your checking account. Don’t spend it multi functional place!

Guarantee correct and environment friendly payroll processing with devoted time monitoring software program.

FREE Direct Deposit Kind

Whether or not you are an employer or an worker who wants a direct deposit kind, obtain one right here, delivered to you by G2!

This text was initially printed in 2019. It has been up to date with new info..