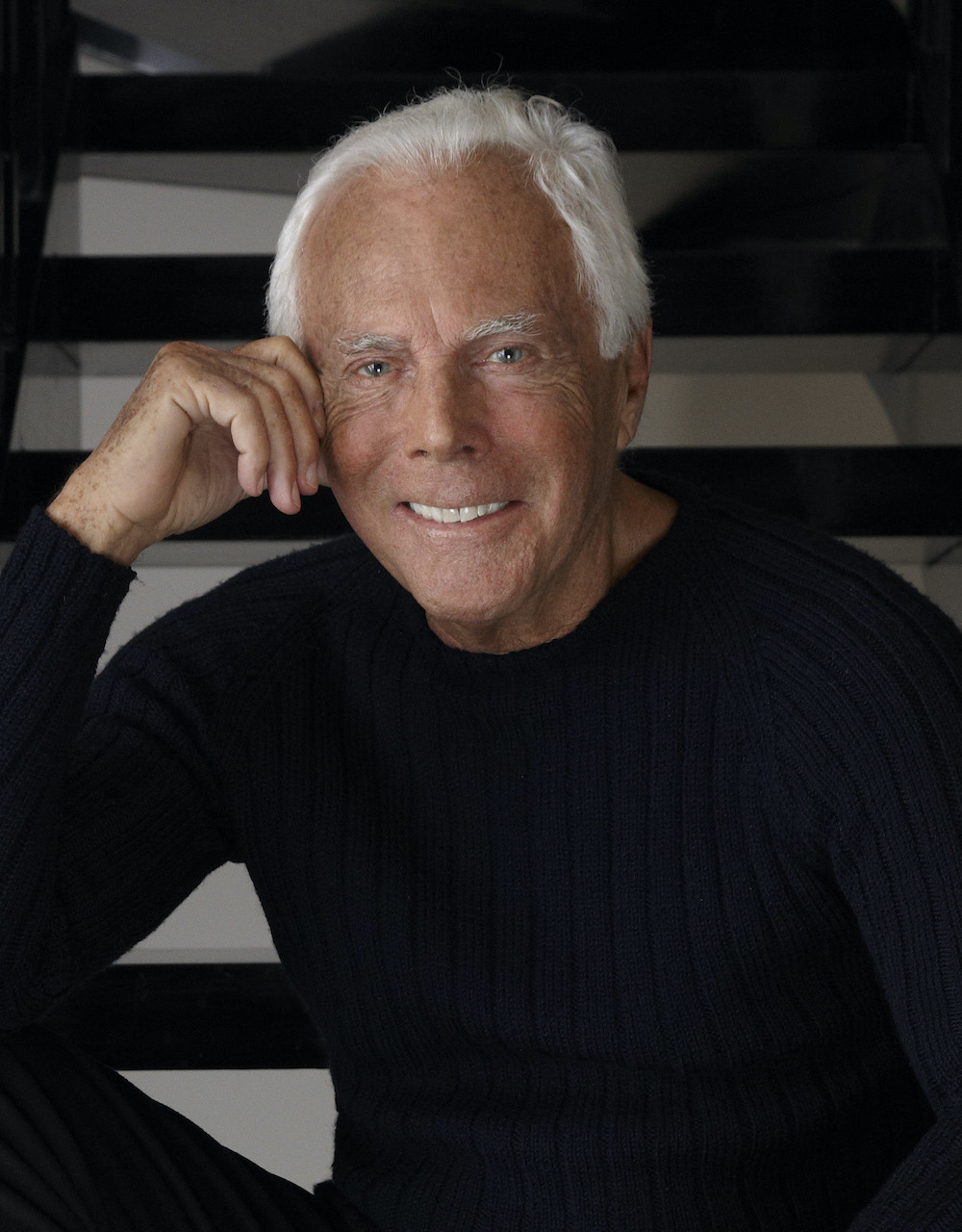

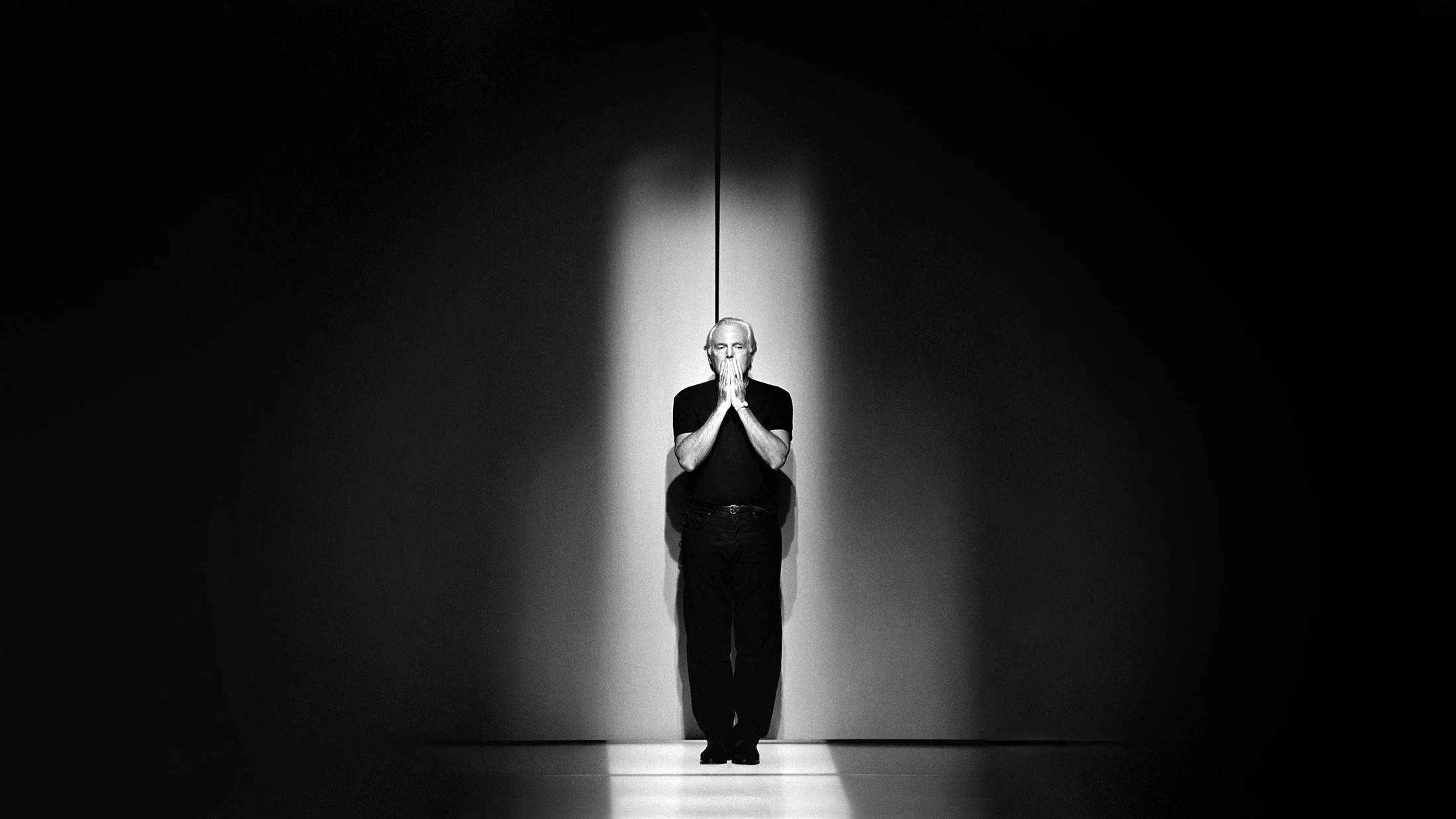

Might this be the start of the top for the Armani empire as we all know it? After Giorgio Armani’s dying earlier this month, the late designer’s will laid out a rigorously staged exit technique for the home he based practically fifty years in the past. The plan entails partial stake gross sales, potential takeover by luxurious conglomerates and probably an IPO, whereas making certain that the Armani legacy and id stay protected. Most popular consumers named within the will embrace LVMH, EssilorLuxottica and L’Oréal. It is a main shift for a model that was lengthy outlined by its independence.

Among the many most well-liked consumers, L’Oréal seems greatest positioned to take the reins. Its long-standing partnership with Armani Magnificence — a line that now generates greater than USD 1.76 billion (roughly EUR 1.5 billion) yearly — provides it not solely monetary leverage but in addition model intimacy. In contrast to EssilorLuxottica — whose power lies in eyewear — or LVMH — which might fold Armani right into a crowded secure of maisons — L’Oréal already capabilities because the face of Armani to hundreds of thousands of shoppers worldwide. On this sense, the French magnificence big just isn’t a distant suitor however a well-recognized “custodian” of kinds that might prolong Armani’s imaginative and prescient into its subsequent chapter.

L’Oréal’s potential acquisition of Armani wouldn’t be its first foray into steering a heritage title into the long run. The French magnificence big has a long time of expertise in absorbing and scaling labels whereas efficiently holding their distinct DNA intact. When it took over Mugler’s magnificence division in 2016, for instance, L’Oréal efficiently revived the perfume arm with blockbuster launches like Alien Man and extensions of Angel, restoring the label’s profitability and cultural relevance. In 2023, Mugler’s trend division was bought individually to Puig, underscoring how L’Oréal has lengthy prioritised magnificence and perfume as its progress engines.

Equally, L’Oréal has labored to fastidiously handle designer tie-ins, holding names like Valentino, Yves Saint Laurent and Prada seen within the luxurious perfume market. By specializing in sturdy product pipelines, savvy celeb campaigns and world distribution, the group has constantly translated status into scale. L’Oréal’s success lies in balancing model heritage with industrial muscle — it not often dilutes a label’s storytelling, as an alternative magnifying its most bankable narratives.

A Legacy in Flux

In 2024, Armani’s trend division reported revenues of roughly USD 2.70 billion (roughly EUR 2.3 billion), having declined by round 5 p.c year-on-year. When magnificence and eyewear licensing (managed by L’Oréal and EssilorLuxottica respectively) are factored in, the entire worth of the model rises to USD 4.52 billion (EUR 4.25 billion). Income from licences performs an important function, with L’Oréal’s Armani magnificence line producing about EUR 1.5 billion yearly and eyewear contributing roughly EUR 500 million. Regardless of this, working margins within the core trend enterprise have shrunk.

Learn Extra: Giorgio Armani Dies at 91 Leaving Behind a USD 12.1 Billion Style Empire

As Giorgio Armani had no youngsters, his will allocates management by way of the Giorgio Armani Basis (arrange in 2016) to his long-time associate Pantaleo “Leo” Dell’Orco and different members of the family. The Basis holds no less than 30.1 p.c of capital, together with sure veto powers over main selections. Dell’Orco is to obtain 40 p.c of voting rights. Different heirs embrace nieces Silvana Armani and Roberta Armani, and nephew Andrea Camerana, with some non-voting shares amongst them.

Armani’s will instructs that inside 18 months of his dying, heirs should promote an preliminary 15 p.c stake within the firm — with precedence given to LVMH, L’Oréal or EssilorLuxottica or to a luxurious group with which Armani has present industrial ties. Inside three to 5 years, the identical purchaser is anticipated to take a bigger stake — between 30 and 54.9 p.c. If no applicable associate emerges, then an IPO needs to be pursued, ideally on the Milan inventory trade or one other comparable market. The need emphasises that the Basis should always retain no less than 30.1 p.c of capital to make sure the model’s values are safeguarded.

Match or Flaw

Like with any new structural possession, challenges and dangers can come up. The truth that Armani has named particular most well-liked consumers sharply focuses consideration on how the model may change underneath new possession. LVMH brings scale, world infrastructure and experience throughout many luxurious classes, however integrating Armani’s inventive type and preserving its signature aesthetic could show difficult. EssilorLuxottica already handles Armani’s eyewear licence and thus has familiarity with a part of the enterprise, however the firm’s core strengths lie in optics relatively than full trend homes. L’Oréal, in the meantime, has following and success within the magnificence section; its present collaborations with Armani imply a stage of belief, however a transfer into trend operations could be a departure from its main enterprise mannequin. Every potential purchaser faces trade-offs between preserving heritage and unlocking scale.

Learn Extra: Armani Group Achieves Steady Development Throughout 2022 and Q1 2023

An IPO different provides one other layer of complexity. Public itemizing might increase capital, enhance transparency and broaden possession. Nevertheless it additionally introduces strain from shareholders, short-term efficiency expectations and threat to inventive autonomy — dangers that Armani has historically managed to keep away from.

Previous Precedent

The luxurious business has already demonstrated how magnificence conglomerates can prolong their attain into trend. In 2022, Estée Lauder acquired Tom Ford in a deal valued at USD 2.80 billion, paying roughly USD 2.30 billion upfront and deferring USD 300 million till 2025. The acquisition gave Estée Lauder full management of the Tom Ford mental property, significantly its profitable magnificence and perfume enterprise whereas outsourcing ready-to-wear and eyewear by way of companions like Zegna and Marcolin. The transfer underlined how a cosmetics big might safe a model’s core belongings whereas leaving trend execution to licensees.

For Armani, the comparability places L’Oréal within the strongest place. Already answerable for Giorgio Armani Magnificence and perfume, L’Oréal has confirmed it may combine fashion-linked homes whereas holding profitability in magnificence on the centre. If Estée Lauder might soak up Tom Ford with restricted trend oversight, L’Oréal is even higher positioned: its longstanding licensing ties with Armani imply it already controls one of many model’s most worthwhile divisions. That relationship — coupled with Armani’s personal succession blueprint — makes L’Oréal the frontrunner in any takeover situation.

READ MORE: Richemont Group Says No to an Acquisition by LVMH

The Way forward for Legacy Manufacturers & The Luxurious Business

Central to Armani’s will is the assure that the Giorgio Armani Basis will stay a guardian of brand name id. The Basis should not maintain lower than 30.1 p.c of capital and carries important voting rights. The chief committee is charged with appointing a brand new CEO and making certain the model’s mission and design rules stay intact.

These measures counsel a dedication to keep away from what some critics describe because the “dying of independence” that befalls many heritage manufacturers after acquisition. With out such safeguards, branding, licensing and inventive path are sometimes topic to short-term revenue pressures. Armani’s specs for voting rights and gradual stake sale are designed to protect towards this.

Learn Extra: Giorgio Armani Cancels Runway Exhibits Amidst Rising Covid-19 Instances

Within the brief time period, the primary 15 p.c sale to one of many named companions appears almost definitely. Because it stands, L’Oréal is taken into account a robust candidate, provided that it already shares licensing relationships and understands income streams underneath the model. Over three to 5 years, that stake might rise or an IPO might change into obligatory if no most well-liked purchaser meets the phrases set by the desire. Dell’Orco and the Basis will retain sufficient affect to form the model’s future path.

Shoppers shall be watching too. Luxurious consumers more and more care about authenticity, heritage and company transparency. A model’s legacy is not only about design; the larger image entails who owns the model, the way it operates and whether or not it maintains its values underneath varied fiscal and artistic pressures. For legacy manufacturers throughout luxurious, the Armani succession plan represents a mannequin that others will examine intently.

Giorgio Armani’s dying marks a turning level not merely as a result of considered one of trend’s most unbiased leaders is gone, however as a result of his exit plan lays naked the tensions between legacy and consolidation. Whether or not the model stays a beacon of unbiased luxurious or turns into one other asset in a conglomerate portfolio now depends upon structured stewardship, strategic partnership and unflinching adherence to the rules Armani set in movement.

Learn Extra: LUXUO Seems Again: Giorgio Armani on his Pantelleria Vacation Residence

For extra on the most recent in enterprise reads, click on right here.