As 2025 approaches, S&P World Mobility forecasts 89.6

million new automobile gross sales worldwide subsequent yr, reflecting cautious

restoration development. 2025 automotive forecasts have been downgraded

throughout the board, reflecting anticipated post-election US coverage

shifts. Ensuing impacts to automobile demand will probably be vital,

particularly rates of interest, commerce flows, sourcing, and BEV adoption

charges.

World new automobile gross sales in 2025 are anticipated to rise 1.7%

year-over-year, to 89.6 million items, in line with a brand new forecast

by S&P World Mobility.

The worldwide auto sector stays targeted on managing manufacturing

and stock ranges in response to regional demand patterns, which

embody slower development in key markets, in some circumstances associated to

slower electrical automobile adoption charges.

The forecast outlook incorporates a number of elements, together with

improved provide, tariff impacts, still-high rates of interest,

affordability challenges, elevated new automobile costs, uneven

shopper confidence, power value and provide issues, dangers in

auto lending and the challenges of electrification. Within the US,

president-elect Donald Trump is anticipated to hit the bottom working

in 2025 with a variety of coverage priorities, together with common

tariffs, deregulation, and wavering BEV assist.

“2025 is shaping as much as be ultra-challenging for the auto

business, as key regional demand elements restrict demand potential and

the brand new US administration provides contemporary uncertainty from day one,”

mentioned

Colin Couchman, govt director of worldwide gentle automobile

forecasting for S&P World Mobility. “A key concern is how

'pure' EV demand fares as governments rethink coverage assist,

particularly incentives and subsidies, industrial coverage, tariffs,

and quick evolving OEM goal setting.”

2024 international automobile gross sales are anticipated to achieve 88.2 million

items, in line with S&P World Mobility. This displays a 1.7%

improve from 2023, supported by ongoing stock restocking

all year long as provide chains grow to be extra steady.

Market-by-market automobile gross sales forecasts

Europe: Wrapping up 2024, the Western/Central

European market ought to ship slightly below 15.0 million items (+1.1%

y/y), as clients stay cautious, and OEMs proceed to fine-tune

their propulsion combine. Into 2025, this storyline will intensify as

strict 2025 emission guidelines additional affect the market combine and

topline, S&P World Mobility forecasts the market flatlining

round 15 million items, up by simply 0.1% y/y – reflecting financial

recession dangers, still-high automotive costs, tapering EV subsidies, EV

tariffs, and political uncertainty in Germany and France.

“Key challenges embody the dynamic electrification storyline,

alongside EU tariffs on mainland Chinese language imports, Trump tariff

dangers, hesitant customers, a brand new EU Fee, and vigorous

lobbying relating to EU emission targets,” Couchman mentioned.

United States: S&P World Mobility tasks

US gross sales volumes to achieve 16.2 million items in 2025, an estimated

improve of 1.2% from the projected 2024 degree of 16.0 million

items and reflective of a nonetheless unsure atmosphere for auto

gross sales ranges.

“2025 brings with it blended alternatives and uncertainty for the

auto business as a brand new administration and coverage proposals take

maintain,” mentioned

Chris Hopson, supervisor of North American gentle automobile gross sales

forecasting for S&P World Mobility.

“New automobile affordability points that coalesced to constrain

auto demand ranges for a lot of 2024 won’t be resolved shortly in

2025. Automobile pricing ranges are anticipated to say no however stay

excessive; rates of interest are anticipated to shift additional downwards, however

inflation ranges are anticipated to stay sticky, and new automobile

stock must also progress, however cautious administration is anticipated

too. Mixed with an uneasy shopper, we challenge this interprets

to gentle development prospects for auto gross sales.”

Mainland China: For the yr ending, the

mixture of the CNY130 billion extension of New Power Automobile

(NEV) incentives, along with the brand new CNY75 billion trade-in

scheme, 2024 is estimated to recuperate to at the least 25.8 million items

(+1.4% y/y), in line with S&P World Mobility. For 2025,

regardless of under par financial exercise, the automotive sector will

proceed to be supported by the NEV and trade-in schemes, alongside

with native authorities auto incentives, wider authorities stimulus,

and the continuation of the automobile value wars. 2025 demand for

Mainland China is forecasted at 26.6 million items, up an extra

3.0% over 2024 ranges.

The NEV increase is prone to lengthen into 2025 with electrified

automobile costs benefitting from cheaper battery prices along with

beneficiant nationwide and regional subsidy packages to assist stimulate

new automobile demand. Coupled with full NEV tax exemption by means of to

the tip of 2025, NEV penetration (as % of passenger autos) is

projected to additional improve to 58% in 2025, from 49% in 2024,

in line with S&P World Mobility estimates.

Japan: Trying to 2025, Japanese gentle automobile

demand ought to be again in development mode following a disappointing

2024, largely reflecting Daihatsu's sudden halt in shipments

as a consequence of emissions irregularities. S&P World Mobility tasks

gross sales volumes to achieve 4.6 million items in 2025, an estimated

improve of 5.4% from the projected 2024 degree under 4.4 million

items. The prospect of US common tariffs, and weaker international

financial fundamentals, might show problematic for Japan—a key

web exporter of cars, particularly to North America, though

anticipated slower US BEV development might supply a silver lining.

2025 automobile manufacturing outlook stagnates as international

dangers intensify

World gentle automobile manufacturing in 2024 is anticipated to complete at

89.1 million items – a 1.6% deterioration in comparison with 2023 ranges,

with all areas besides mainland China and South America

experiencing decline.

The manufacturing outlook for 2025 is dominated by the belief

that the incoming US administration will levy a brand new wide-reaching

tariff regime, successfully making a common tariff of 10% on

all items coming into the US aside from Canada and Mexico the place the

phrases of the USMCA are assumed and mainland China the place it’s

assumed a tariff of 30% will probably be utilized.

For 2025, S&P World Mobility forecasts international gentle automobile

manufacturing ranges to say no by 0.4%, to 88.7 million items. The

tariff results are tough to isolate in every area particularly

contemplating the continued challenges of stock administration, and

with continued volatility on the automobile program degree as OEMs make

strategic changes to their future product plans.

“The auto business continues to navigate unsure terrain as we

enter 2025, notably as we anticipate President-elect Trump's

incoming common tariffs,” mentioned

Mark Fulthorpe, govt director of worldwide gentle automobile

forecasting for S&P World Mobility. “Throughout 2025, the

manufacturing panorama will change dramatically, as international commerce

slows, and as retaliatory measures are prone to emerge.”

In mainland China, S&P World Mobility forecasts steady

manufacturing ranges for 2025, up 0.1%, at 29.6 million items. Output

ranges ought to be supported by a mixture of heady NEV home

demand, alongside strong exports, albeit tempered by EU import

tariffs on Chinese language-made BEVs.

For the North American area, general 2025 manufacturing is ready to

fall again by 2.4%, to fifteen.1 million items. The incoming Trump

administration will mark a return to the predictably unpredictable

with insurance policies which are anticipated to affect general demand and

problem automobile combine assumptions. On a brighter observe, deregulation

ought to create tailwinds for the North American auto business later

in President Trump's second time period.

Europe is anticipated to construct 16.6 million items in 2025, down

2.6% from an estimated 17.0 million in 2024. The outlook displays

propulsion combine nice tuning prepared for the 2025 step change in EU

emissions guidelines, alongside new tariff/commerce assumptions related

with the incoming Trump administration, with premium autos

notably in danger.

Client uncertainty round electrification, particularly

velocity bumps in Europe & US

By way of 2024, a bunch of OEMs have been strolling again bold

electrification plans for the approaching 5 to fifteen years. A key

concern is how “pure” EV demand fares, as governments fine-tune

coverage assist, particularly incentives and subsidies, EV industrial

coverage, and tariffs. Outdoors China, automakers face twin challenges

within the electrification transition—scaling output of sellable

BEVs and discovering keen clients to purchase them.

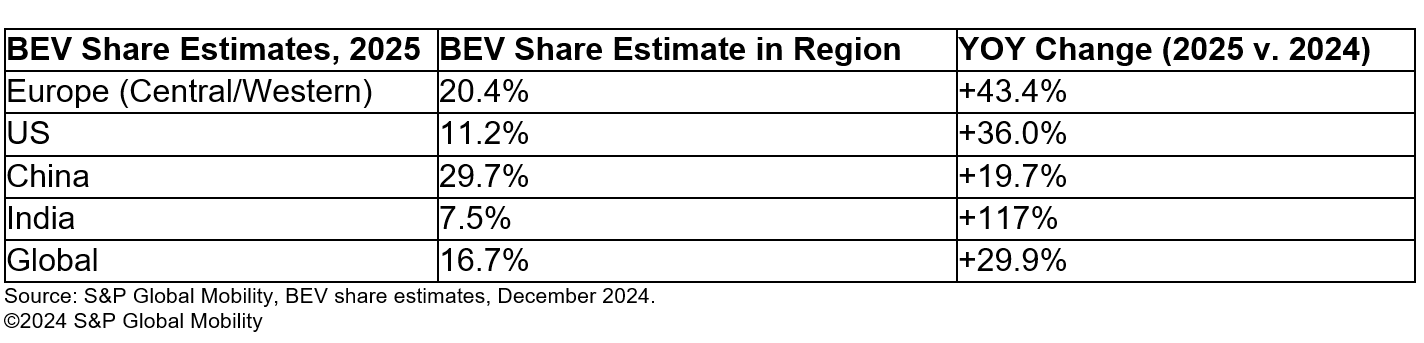

Regardless of the gloom, electrical autos stay an necessary

automotive development sector, and S&P World Mobility tasks

international gross sales for battery electrical passenger autos to submit 15.1

million items for 2025, up by 30% in comparison with 2024 ranges,

accounting for an estimated 16.7% of worldwide gentle automobile gross sales.

For reference, 2024 posted an estimated 11.6 million BEVs globally,

for 13.2% market share.

Main markets are forecast for many of this quantity, although

smaller markets may also see modest will increase. Forecasted BEV

share by area is as follows:

Wanting past 2025, many uncertainties persist relating to the

tempo of electrification, particularly relating to charging

infrastructure, grid energy, battery provide chains, international sourcing

traits, tariff commerce limitations, the speed of technological

developments, and the required degree of assist from policymakers

to facilitate the shift from fossil fuels to electrical

options.

At present, China's NEV program and Europe's “Match for 55”

initiative stay intact to assist a sustainable mobility future.

Much less clear are President-elect Trump's intentions for US electrical

automobile assist, particularly relating to the IRA and varied coverage

initiatives.

Entry a pattern of our Mild Automobile Gross sales Forecast

knowledge.