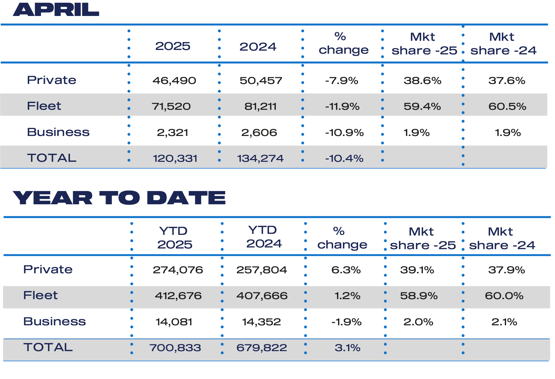

New automobile retail demand took an 8% hit in April as tax adjustments began to chunk, however the personal market remains to be up 6.3% year-to-date.

The most recent information from the Society of Motor Producers and Merchants (SMMT) exhibits that the general market was down by 10.4% or 13,943 items to 120,331 items in whole, however the largest drag on registrations was the fleet sector.

Fleet and enterprise demand dropped by 11.9% and 10.9% respectively in April.

> New automobile gross sales registration information

It was the sixth fall within the final seven months, which the SMMT mentioned displays “a fragile financial backdrop and weakened client confidence, with 13,943 fewer automobiles registered within the month in contrast with the yr earlier than and 25.3% behind pre-pandemic April 2019”.

In what’s historically a quieter month following the March plate change, volumes have been additionally impacted by the late timing of Easter, leading to fewer working days.

As well as, the implementation of VED adjustments affecting all new automobiles, together with the Costly Automotive Complement which grew to become relevant to many new EVs from April 1 , pushed transactions into March as shrewd patrons acquired forward of the tax will increase.

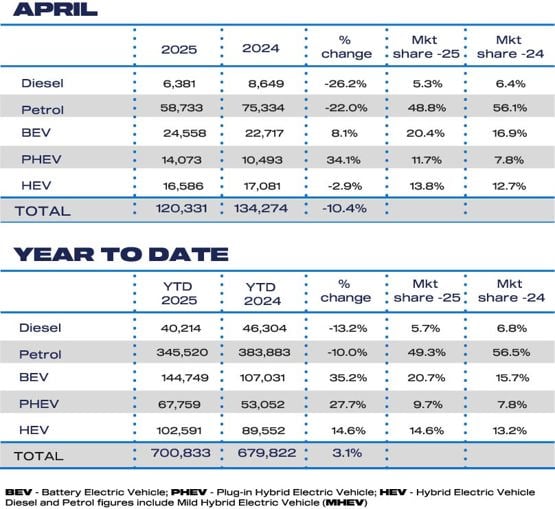

Plug-in autos take a fifth of UK new automobile market

By way of powertrain efficiency, demand for hybrid electrical autos (HEVs) fell 2.9%, with petrol and diesel registrations down 22.0% and 26.2% respectively.

Conversely, registrations of autos with a plug rose: plug-in hybrids (PHEV) up 34.1% and battery electrical autos (BEV) growing 8.1% to 24,558 items, taking greater than a fifth (20.4%) of the market.

Mike Hawes, SMMT chief government, mentioned: “April’s efficiency is disappointing however anticipated after March’s surge.

“One other month of progress for electrical car registrations is sweet information, nonetheless, even when demand stays properly under ambition.

“Latest Authorities changes to flexibilities and compliance throughout the ZEV Mandate are welcome and an essential first step in relieving a number of the stress in the marketplace and producers.

“Nonetheless, EV uptake remains to be being closely and unsustainably subsidised by the trade which is why a compelling bundle of measures from Authorities is important if customers are going to make the change.”

The most recent market outlook revises up full yr 2025 new automobile registrations to 1.964 million items however retains 2026 expectations under the 2 million mark for what can be the seventh successive yr.

Market share expectations for brand new BEV registrations, in the meantime, stay pretty fixed with solely a marginal revision downward from the January view, by 0.2 proportion factors to 23.5% for this yr, and down by 0.3 proportion factors to twenty-eight% subsequent yr, in contrast with the ZEV Mandate targets of 28% and 33% respectively.

Kia and Ford prime the quantity charts

Authorities ought to provide clear and long-term help to UK automotive retailers

Sue Robinson, chief government of the Nationwide Franchised Sellers Affiliation (NFDA), mentioned BEVs have continued on an upward trajectory after a constructive begin to the yr.

Nonetheless, each fleet and personal demand have seen downturns, reflecting ongoing challenges out there.

She mentioned: “The beginning of the brand new fiscal yr has introduced additional pressures, with will increase to employers’ Nationwide Insurance coverage contributions and the extension of Automobile Excise Obligation and the Costly Automotive Complement to EVs.

“The Authorities’s current adjustments to the ZEV Mandate replicate a number of key suggestions from NFDA’s session response, together with the popularity of hybrids as a transitional answer past 2030.

“That is welcome however we reiterate that extra might be executed to align the UK with the remainder of the world.

“Amidst ongoing financial uncertainty and the potential affect of US tariffs, it’s extra essential than ever that the Authorities affords clear help and long-term certainty to UK automotive retailers.”

Ian Plummer, industrial director at Auto Dealer, mentioned: “Quick time period turbulence is most definitely accountable for April’s softening new automobile gross sales, however we’re seeing new automobile visits on Auto Dealer up 8% on 2024 and we’re assured this may convert to gross sales within the coming months.

“Whereas any progress in electrical gross sales is welcome, we’re nonetheless lagging behind the ZEV mandate goal this yr.

“New and extra reasonably priced fashions are turning heads and will assist get us nearer to the goal, with the brand new EVs that launched final yr accounting for 1 / 4 of all new electrical advert views.”

Client notion on EVs nonetheless must shift

Jamie Hamilton, automotive companion and head of electrical autos at Deloitte, mentioned April was all the time set to be a low quantity month, however famous that it’s nonetheless disappointing to see gross sales stall at a time when the trade is looking out for indicators of positivity out there.

He mentioned: “Though gross sales of battery electrical autos proceed to develop throughout the sector, it’s clear that client notion on EVs nonetheless must shift.

“With ongoing considerations over value and charging infrastructure nonetheless commonplace, extra must be executed to help personal patrons interested by switching to electrical.”

As tariffs on automobiles being bought to the US are carried out, Hamilton mentioned the consensus view from trade analysts is that demand for brand new automobiles within the US is about to fall this yr.

That is prone to have a fabric affect on UK automobile manufacturing, with the US a key marketplace for UK automotive firms.

On prime of this, Deloitte’s current Q1 CFO survey highlighted that companies have been turning into extra defensive, with a better concentrate on price management in mild of geopolitics being rated as the highest danger to companies.

With fleet gross sales persevering with to drive progress within the sector, any pull again on funding may decelerate the flexibility of fleet managers to replenish their inventory of autos.

He added: “From a personal purchaser’s perspective, there can be considerations that a flattening of client confidence may imply some customers suppose twice earlier than making a big buy.

“Nonetheless, there are constructive indicators within the UK financial system, together with actual wage progress, which can show encouraging for customers contemplating automobile purchases.”