Collaborations with worldwide companies and investments

in abroad markets have helped Chinese language industrial automobile

firms increase their attain.

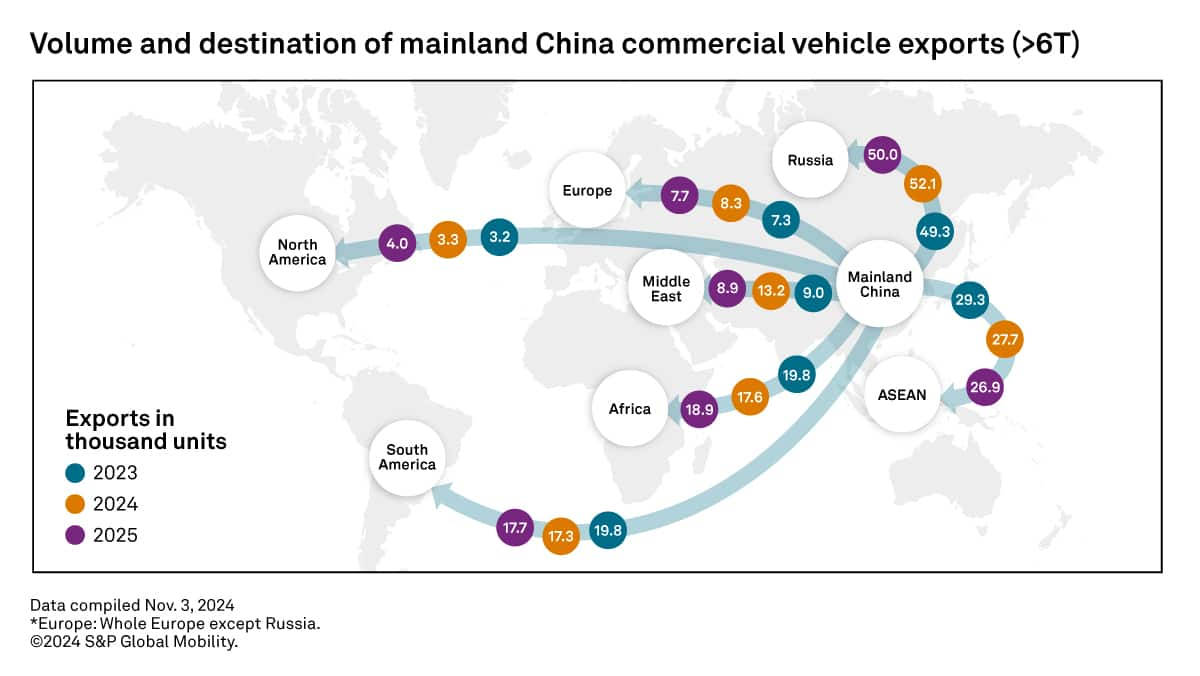

Mainland China is the world's largest producer and exporter of

medium and heavy industrial automobiles (MHCV) weighing greater than six

metric tons. Mainland China's strong manufacturing capabilities,

aggressive pricing and skill to fulfill the wants of various

international locations drive this success.

Surge in Exports Pushed by Aggressive

Benefits

Due to these strengths, Chinese language producers have

considerably elevated their share of worldwide markets during the last

4 years.

In 2022, exports of heavy tractor-trucks led this progress, extra

than doubling from the yr earlier than. China's Belt and Street

initiatives have additional boosted exports, with core export

locations in Southeast Asia, the Center East, Africa and South

America. We define this progress in our

MHCV export module, which covers 75 international locations.

The Publish-Pandemic Export Increase: A Fast Development

Part

Since 2021, Mainland China's exports of MHCVs have surged,

coming into a speedy progress part following pandemic-related provide

chain disruptions that affected abroad manufacturing. Whereas

Western OEMs confronted a scarcity of chips and different core parts,

many Chinese language automakers had home entry to an entire

industrial chain, which helped quickly improve capability whereas

Western automakers needed to minimize manufacturing.

From 2021 to 2023, industrial truck exports from Mainland China

skilled a outstanding compounded annual progress fee (CAGR) of

33.5%, reaching an all-time excessive in 2023. Heavy-duty vans (over

15 tons) — which noticed a CAGR of 43.6% and accounted for 77.6% of

the entire export quantity in 2023 — primarily drove this

progress.

Japanese Europe: A Key Marketplace for Chinese language Heavy

Vans

In 2021, demand for Chinese language heavy vans surged by 112% within the

Japanese European market, largely as a result of elevated demand from

Russia. Because the battle between Russia and Ukraine unfolded, all

Western auto producers exited the Russian market, which allowed

Chinese language truck manufacturers to seize a bigger share.

Attributable to modifications in Russian tax guidelines, Russia turned the highest

vacation spot of Chinese language MHCV exports from 2021 to 2023. As Russia

appears to be like to bolster its economic system and infrastructure, demand for Chinese language

items — starting from equipment to client merchandise — has

surged.

China and Russia have been strengthening their political and

financial ties, fostering a extra conducive setting for commerce.

Elevated vitality exports from Russia to China have additionally facilitated

commerce. Consequently, MHCV exports to Russia rose by 172% from 2021

to 2022, totalling 25,900 models, with heavy vans main this

progress.

Prime exporters to Russia in 2022 included CNHTC, Hongyan,

Jianghuai and Shaanxi Auto Heavy. In 2023, exports to Russia

continued to climb, rising by 90% to surpass 49,300 models.

Projected Export Development to Russia and Different Japanese

Markets

Manufacturers like Dongfeng, FAW, Foton, SANY, and Yutong have additionally

expanded their presence within the Russian market. Based mostly on S&P

World Mobility's

November 2024 export forecast, we challenge exports will rise by

5.7% to 52,200 models, with CNHTC, Dongfeng, FAW and Shaanxi Auto

Heavy anticipated to stay the main exporters.

ASEAN and Africa: Strengthening Ties and Increasing

Market Share

Traditionally, ASEAN and African international locations have been prime export

locations of Chinese language MHCV producers. Chinese language producers

now need to capitalize on native authorities incentives to make their

merchandise extra aggressive and achieve extra market share.

To take action, Chinese language MHCV producers are opening manufacturing or

meeting models both on their very own or in three way partnership with native

gamers in these markets, together with:

- Yutong, which in collaboration with TC Motor Holding is opening

a bus and battery manufacturing unit in Malaysia. - BYD, which in collaboration with Rever Automotive is opening a

truck and bus meeting plant in Thailand. - King Lengthy, which in collaboration with TC Motor Holding began

native meeting of the Nova bus in Vietnam. - Golden Dragon, which is nearing completion of its meeting unit

in Vietnam with a projected capability of 5,000 buses yearly. - CNHTC and Yutong, which can begin native meeting of sure

fashions of vans and buses, respectively, in South Africa.

Our trucking business forecast expects most of those

manufacturing/ meeting models to change into operational by subsequent yr,

which can result in decreased exports to those international locations from

Mainland China (see map, above).

South America: Sturdy Development in Exports to the Andean

Area

Chinese language exports to South American markets, notably within the

Andean area, noticed vital progress in 2022 of 62%, primarily

pushed by elevated gross sales on South America's Pacific coast and in

Chile, Colombia and Ecuador.

Producers reminiscent of Foton, FAW Jiefang, Jianghuai (JAC) and

CNHTC have enhanced their presence in these international locations, resulting in

a formidable 85% rise in MHCV exports from 2021 to 2022.

We anticipate that China will maintain this export stage within the

coming years. Though we anticipate exports to the Mercosur area to

stay secure, we challenge a slight improve for Brazil. Total,

South America is poised to proceed because the third-largest export

marketplace for Chinese language vans and buses, after Russia and ASEAN.

North America: Commerce Boundaries Restrict Development within the

US

In North America, exports to the US — the most important marketplace for

industrial automobiles within the area — will both stay at similar

stage or lower because of the ongoing commerce conflict with China.

Within the brief time period (2023-2026), we forecast a lower in exports

to European international locations and the US as uncertainties over the

geopolitical scenario and commerce obstacles hinder imports from

Mainland China. Nonetheless, exports to Mexico will improve and act as

bridge between the US and Latin American markets.

Mainland China's Increasing World Footprint

Mainland China's position as a prime exporter and its robust export

progress, particularly to areas like Russia and South America,

spotlight its capability to beat geopolitical challenges and

handle provide chain disruptions. Collaborations with native companies in

ASEAN and Africa additional strengthen China's market penetration and

competitiveness.

Though exports to Europe and the US could lower as a result of commerce

tensions, the general outlook stays constructive, with continued

progress projected in key areas. As Chinese language producers increase

their international footprint, they’re well-positioned to take benefit

of latest alternatives within the evolving industrial transportation

market.

For mannequin stage data, readers can consult with our MHCV

Export Module or contact their S&P World consultant.