International fairness markets have been below strain in latest periods amid fears of a possible U.S. recession, triggered by cooling labor market circumstances and struggling manufacturing exercise.

Regardless of final month’s enterprise surveys displaying enlargement in providers exercise, buyers stay frightened that the world’s largest financial system could also be slowing down, which might curb U.S. family discretionary spending and scale back company earnings.

Dangerous property have been on the epicenter of the present market turmoil, as shares worldwide skilled heavy declines.

- Over the previous three periods, Japan’s Nikkei 225 index plummeted by 19.5%, marking its worst three-day drop for the reason that index’s inception in 1950.

- The Russell 2000 index, which tracks U.S. small-cap shares, skilled a ten% decline throughout the identical interval.

- The Nasdaq 100, represented by the Invesco QQQ Belief QQQ, has seen a 12% drop from its all-time highs in July.

- The CBOE Volatility Index (VIX), also known as the market concern index, surged to briefly hit 60 factors on Tuesday, its highest degree since March 2020.

What Has Occurred To Curiosity Fee Futures?

Recession fears, coupled with international fairness market turmoil, have sparked wild hypothesis about Federal Reserve rate of interest cuts.

Every week in the past, the market assigned solely an 11.4% likelihood to a 50-basis-point charge minimize in September, a chance that has now surged to 97.5%, in response to the CME Group FedWatch instrument.

Equally, every week in the past, the chance of year-end rates of interest falling to 4-4.25% was zero, however as of Monday, it has rocketed to 72%.

Market-Implied Possibilities For Sept. 18’s Fed Assembly

| Fee-cut occasion | Now* | 1 Day In the past | 1 Week In the past July 29, 2024 |

| 50bp to 4.75-5% | 97.5% | 74% | 11.4% |

| 25bp to 5-5.25% | 2.5% | 26% | 88.2% |

Market-Implied Possibilities For Dec. 18’s Fed Assembly

| Yr-end fed funds charge | Now* | 1 Day In the past | 1 Week In the past, July 29, 2024 |

| 4-4.25% | 71.8% | 66.8% | 0.0% |

| 4.25-4.5% | 28.2% | 33.2% | 0.0% |

| 4.5-4.75% | 0.0% | 0.0% | 65.1% |

| 4.75-5% | 0.0% | 0.0% | 34.9% |

Additionally Learn: Goldman Sachs Raises US Recession Odds: Treasury Yields Tumble, Yen Rallies As Merchants Guess On Heavy Fed Fee Cuts

5 ETFs Rallying On International Market Turmoil

Whereas international fairness markets have skilled important declines, safe-haven property have maintained their standing and successfully shielded investor portfolios from volatility.

Furthermore, leveraged and inverse funding methods on fairness indices or shares have additionally seen sharp rallies amid market selloffs.

Listed below are 5 exchange-traded funds (ETFs) which have rallied over the previous couple of periods:

- The Invesco CurrencyShares Japanese Yen Belief FXY has been a major beneficiary of the worldwide market rout, as declining rate of interest expectations in the USA have decreased the greenback’s “carry commerce” benefit in opposition to the yen. Over the previous 4 periods, the FXY ETF has surged by 6.6%, marking its strongest rally since October 2008.

- The iShares 20+ Yr Treasury Bond ETF TLT has posted positive factors for eight consecutive periods, surging over 3.1% final Friday as fears of a cooling U.S. labor market emerged.

- The ProShares Belief VIX Brief-Time period Futures ETF VIXY skyrocketed by over 20% on Monday alone, and by practically 66% over the past three periods.

- The ProShares UltraPro Brief QQQ SQQQ, which goals to realize funding outcomes equal to a few instances the inverse of the every day efficiency of the Nasdaq 100 index, has surged by over 23% previously three periods.

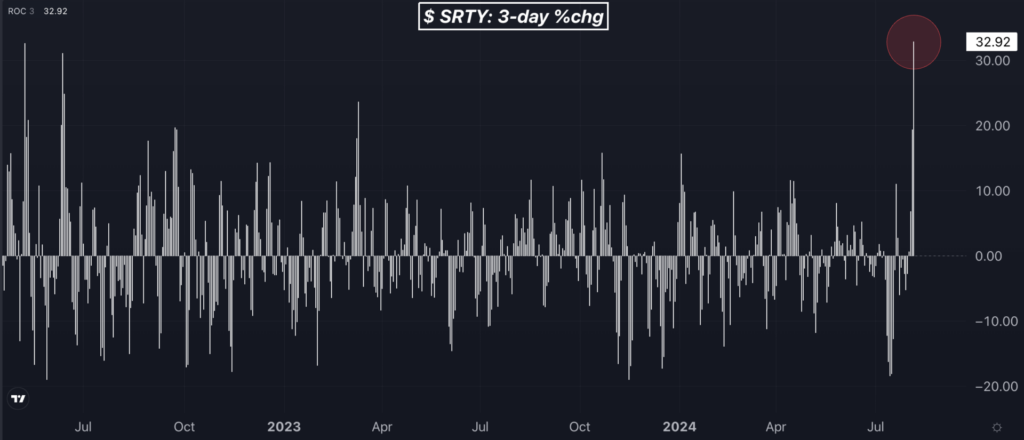

- The ProShares UltraPro Brief Russell 2000 SRTY, designed to hunt an funding efficiency equal to a few instances the inverse of the every day transfer of the Russell 2000 index, has rallied by practically 33% within the final three periods.

Chart: Inverse And Leveraged ETF Methods on US Small Caps Spike Amid Market Turbulence

Picture: Benzinga Professional

Learn Subsequent:

Picture created utilizing synthetic intelligence by way of Midjourney.

Market Information and Information dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.