This

Gasoline for Thought version gives an excerpt from

our new particular report, 2024 US election and the automotive

ecosystem: How a lot change to count on?

Probably the most impactful presidential elections in United

States historical past is scheduled for November 5, 2024. Whatever the

end result, the next points are anticipated to instantly have an effect on the

US auto trade:

- The notion of an existential risk from mainland Chinese language

automakers and know-how firms; - Positions on environmental coverage, notably as pertains to

automobile emissions and security laws; - Commerce coverage because it pertains to each USMCA and potential for

nationwide safety tariffs; and - Positions relative to unions and labor.

At S&P World Mobility, we’re taking a look at each doable

state of affairs and the way varied outcomes might change (or not change) the

greater image for the auto trade.

You will need to observe that coverage adjustments won’t be

speedy and will take a lot of the subsequent presidency to execute.

Even after the election, the trajectory of the brand new administration

and their focus won’t be recognized till early- to mid-2025.

We count on many firms are seemingly holding main selections

till after the make-up of the White Home cupboard and advisors

turns into clearer, in addition to taking time to know the affect of

the Congressional and state elections.

For example, Republicans are vocal about wanting to scale back

funding for the federal packages beneath the Inflation Discount Act.

Some states with automotive industrial funding vote Republican

and others vote Democrat. Home and Senate representatives from

these states have a stake in sustaining an inviting financial

surroundings for the district or state they symbolize in addition to

loyalty to occasion affiliation. The end result may cause voting alongside

occasion strains which can battle with constituent priorities, and

vice versa.

In

our new particular report, we element a number of eventualities and the way we

see they could unfold from a coverage perspective. For anybody with a

stake within the trade, shifting to a state of affairs mindset turns into

vital for decision-making. A single forecast is just one

guideline. Essential selections want to think about enterprise and market

demand points within the context of higher and decrease bounds derived from

believable eventualities, together with a baseline forecast.

Potential coverage adjustments, relying on the state of affairs,

embrace:

- 2028+ federal emissions and gas economic system laws

- Inflation Discount Act funding future

- Mainland China sourcing tariffs

- California: Does its skill to manage emissions

proceed? - 2026 USMCA Evaluate

Most Doubtless Outcomes

There are 4 principal outcomes for the election itself.

S&P World Mobility doesn’t predict which occasion will win,

although we do count on the most probably outcomes shall be a break up

Congress no matter whether or not the Republican or Democratic occasion

wins the White Home. These are the 2 eventualities we concentrate on in

our report.

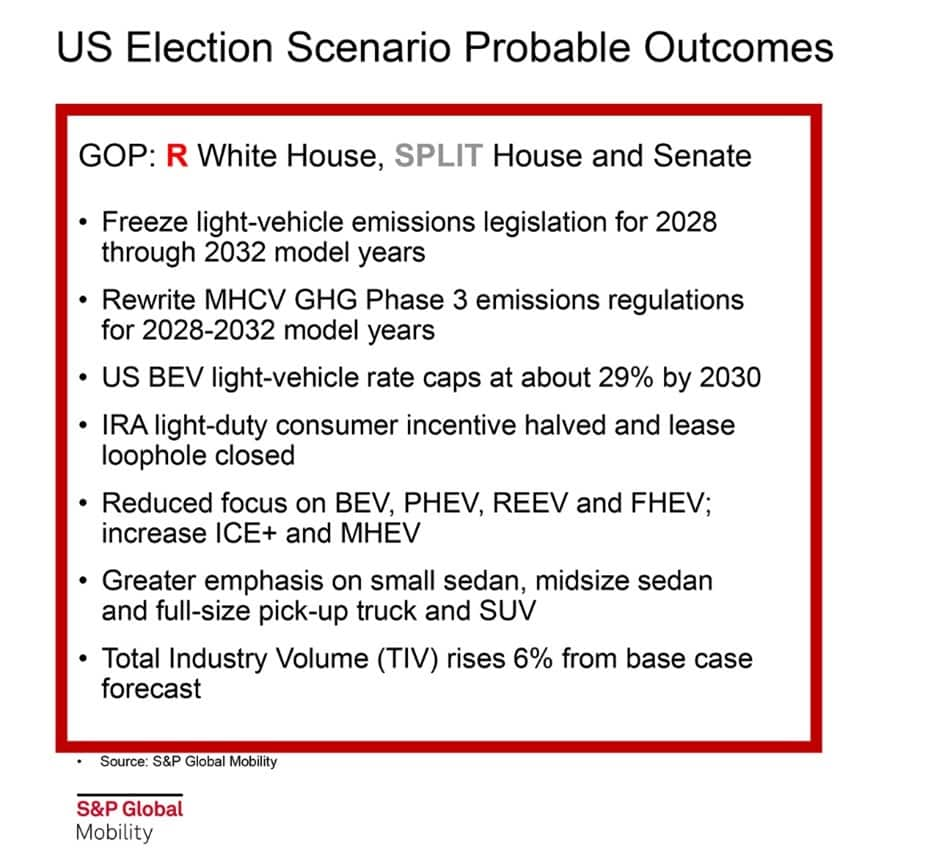

If the Republican occasion wins the White Home

and there’s a break up Home and Senate then we count on there shall be

a choice to freeze the emissions laws overlaying mannequin years

2028 by 2032. This freeze would successfully maintain the

laws set for 2027 mannequin yr regular by no less than 2032

mannequin yr. We might additionally count on to see client tax credit within the

IRA legislation minimize by half, and the present lease loophole to be

closed.

Our state of affairs forecast on this case sees US battery electrical

automobile (BEV) market share of recent gentle automobile gross sales reaching

about 29% by 2030. We might count on the change in emissions

laws to end in a lowered concentrate on greater ranges of

electrification (together with BEV, plug-in hybrid, range-extender

electrical and fuel-cell electrical options), however a rise in

inside combustion engines with delicate ranges of electrification and

mild-hybrid options.

On this state of affairs, the affect might embrace decrease automobile pricing,

much less strain for client behavioral change, a higher emphasis on

small and midsize sedans, in addition to full-size pick-up and SUV

segments. General, we see this state of affairs with a 6% improve in whole

trade quantity (TIV) from the bottom case at this time.

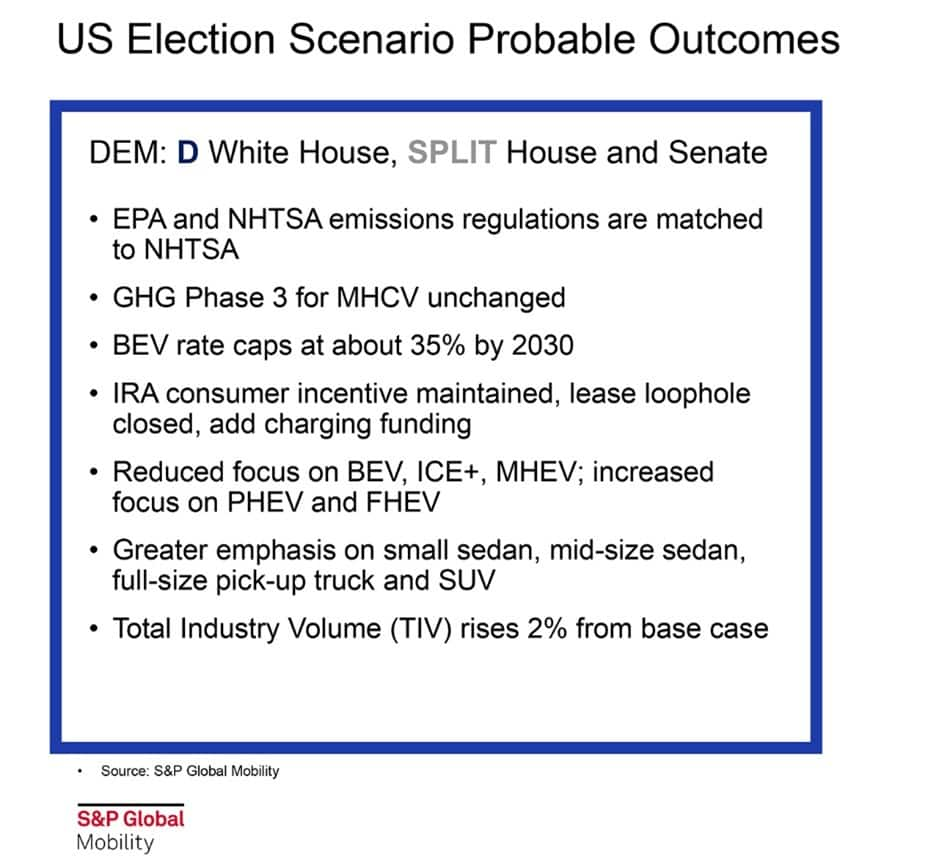

If the Democratic Get together takes the White Home

we expect it’s most probably that the Democrats will even see a break up

Home and Congress. This state of affairs may result in EPA and NHTSA

emissions laws matched to NHTSA tips and for IRA

client incentives to be protected. Although the lease loophole is

nonetheless more likely to be closed, there may be potential for added

incentives for dwelling chargers.

Underneath this state of affairs, we count on an elevated concentrate on PHEV and

FHEV, with a lowered concentrate on BEV, ICE-plus and MHEV. The adjustments

may additionally create higher emphasis on sedans (small and mid-size)

as with the Republican state of affairs, although we count on full-size pickup

and SUV segments flattening. Whole trade gentle automobile quantity

would improve 2% from our base case beneath this state of affairs.

Of observe, seeing elevated emphasis on small and mid-size sedans

in each eventualities additionally displays that these segments have

historically been extra inexpensive in addition to extra environment friendly than

vehicles or utility automobiles. No matter political occasion, the US

market is in want of extra automobiles at inexpensive worth factors, and

the trade, nevertheless slowly, will reply.

Conclusion

For the auto trade, uncertainty associated to laws has

been one of the crucial tough parts to navigate, and

uncertainty is rampant at this time. The November 2024 election follows

different latest elections for having potential for enormous affect on

the auto trade. The affect and associated uncertainties contact

practically each aspect of the trade. As soon as the make-up of the following US

presidential administration and Congress are settled, the trade

ought to have a greater grasp of what the following 4 years will look

like, relative to some US insurance policies. No matter adjustments or stays the

similar in coverage and regulation, a constant framework is what the

trade wants to raised navigate and perceive methods to compete

profitably within the US market.

Obtain the complete particular report

Watch the webinar

Hearken to the podcast

Ask about our eventualities workshops

This text was printed by S&P World Mobility and never by S&P World Scores, which is a individually managed division of S&P World.