Pay attention

to the Gas for Thought podcast

Because the automotive {industry} prepares for the potential

uncertainties of a second Trump administration, the worldwide influence

on electrical automobiles (EVs), tariffs, taxes, and commerce relations is

profound. The president-elect's proposed insurance policies, together with tax

cuts, deregulation, tariffs, and modifications to EV incentives, will

have ripple results on world automotive markets, particularly in

North America and Europe.

How these insurance policies unfold will form the way forward for battery

electrical car (BEV) gross sales and world commerce dynamics.

Tax Cuts and Car Affordability: A Double-Edged Sword

One of many cornerstone insurance policies of a second Trump administration

is tax cuts, together with making the reductions from the Tax Cuts and

Jobs Act of 2018 everlasting, eliminating taxes on tipped earnings,

extra time and social safety advantages and eradicating the cap on

state/native tax deductions. For companies, he has pledged to

cut back company fee from 21% at the moment to fifteen%.

Whereas this might stimulate financial development, disposable earnings,

and client spending within the brief time period, the long-term results are

much less sure. Larger demand, mixed with potential inflationary

strain, may result in greater borrowing prices, which might dampen

car affordability.

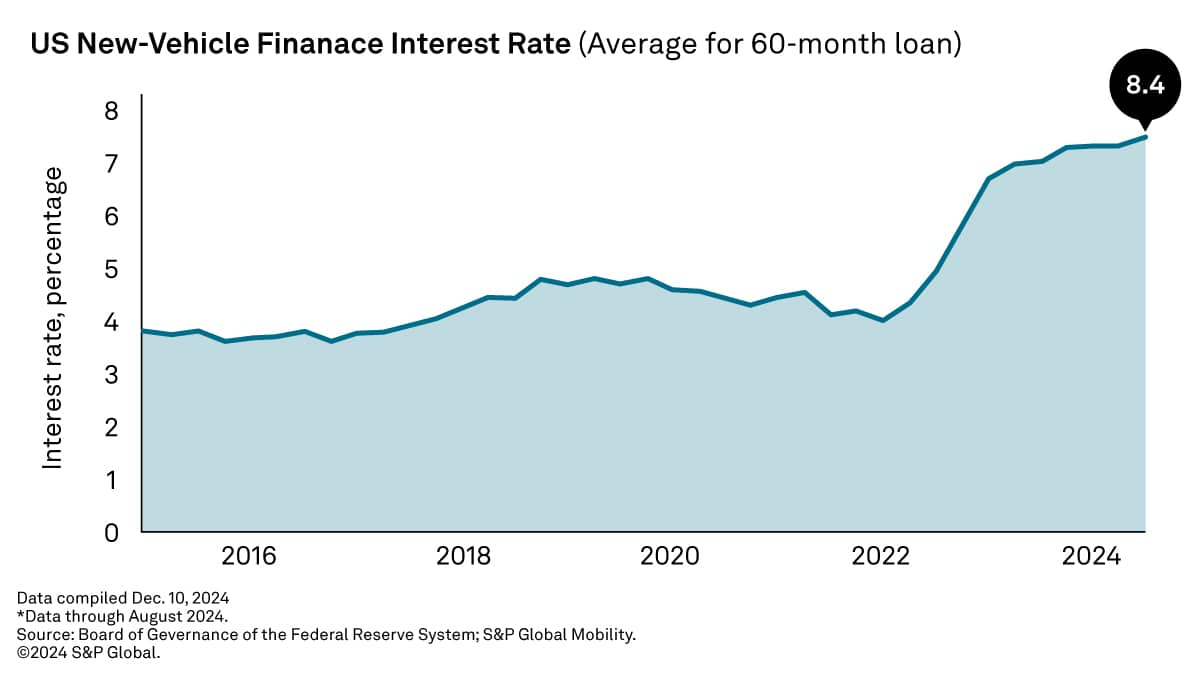

In North America, the place 86% of US customers depend on financing

(lease or mortgage) for brand spanking new automobiles, the automotive market faces a

delicate balancing act. If rates of interest rise because the Federal

Reserve takes motion to fight inflation, the price of automotive loans

would enhance, resulting in greater month-to-month funds. This state of affairs

might make customers assume twice earlier than buying new automobiles,

together with EVs, which usually carry greater upfront prices in contrast

to conventional inner combustion engine automobiles.

The Function of Tariffs: Disruptions and Commerce Limitations

Commerce limitations, significantly tariffs, are one other potential

crucial facet of the second Trump administration. All through his

first time period, Trump used tariffs as a negotiating instrument in commerce

talks, and these measures may escalate once more, particularly to

offset the prices of tax cuts.

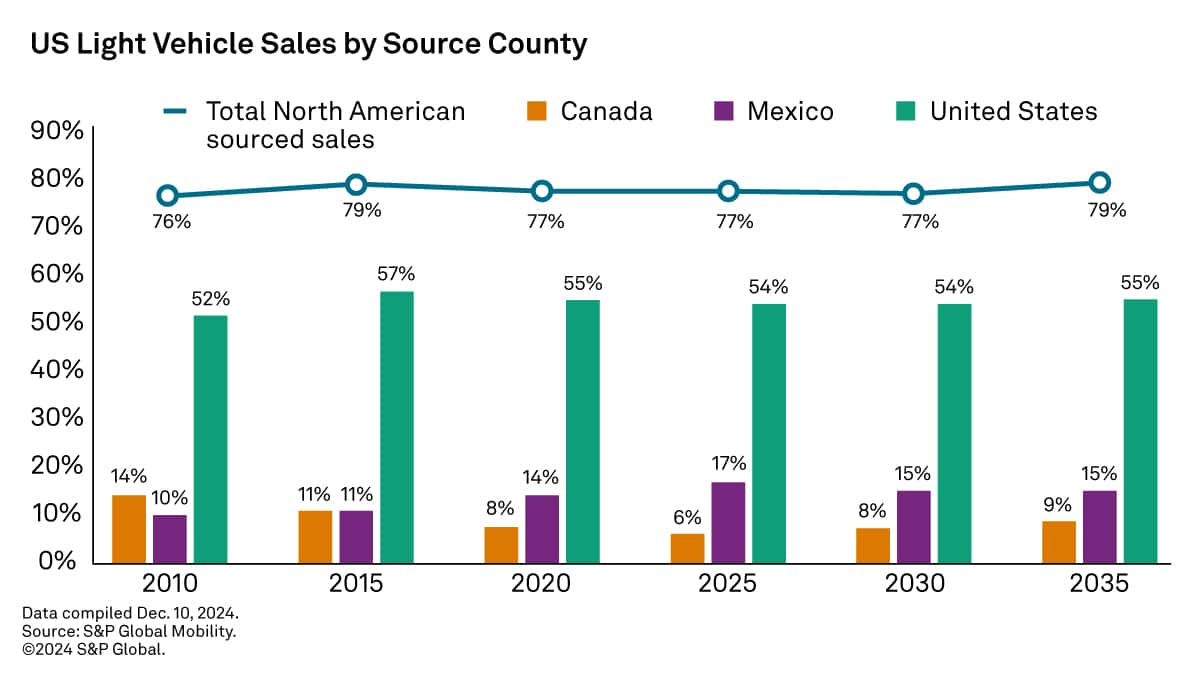

A proposed 10% tariff on imported automobiles from areas like

Japan, Korea, and Europe would straight influence 16% of US car

gross sales. Nonetheless, the extra regarding facet could be the potential

for a 25% tariff on imports from Canada and Mexico, key buying and selling

companions underneath the USMCA (United States-Mexico-Canada

Settlement).

Roughly one out of each 4 automobiles

offered within the US comes straight from Canada or Mexico; these automobiles

shall be uncovered to tariffs. Moreover, such tariffs would

disrupt a extremely built-in North American automotive provide chain,

which depends on components and elements flowing freely between the US,

Canada, and Mexico.

With the US importing over $92 billion in

automotive items yearly from these international locations, a tariff enhance

would result in manufacturing delays, greater manufacturing prices, and,

finally, elevated costs for customers.

These disruptions would additionally prolong to the broader world

market. For instance, tariffs may complicate the worldwide commerce

setting, influencing car pricing and manufacturing volumes in

Europe and Asia, particularly as automakers more and more look to

handle manufacturing prices and client affordability.

Deregulation and Its Affect on Battery Electrical Car

Gross sales

A doubtlessly extra vital shift underneath a second Trump

administration is the rollback of environmental laws,

together with gas economic system requirements and incentives for BEVs. Underneath the

earlier administration, aggressive gas economic system requirements and the

push for EV adoption had been central to the automotive {industry}'s

future. Nonetheless, with the expectation of relaxed laws,

automakers might face much less strain to affect their fleets.

The Nationwide Freeway Visitors Security Administration (NHTSA) is

already contemplating loosening gas economic system requirements for mannequin

years 2027 and past, and the Environmental Safety Company

(EPA) is prone to revise long-term carbon dioxide (CO2)

requirements.

This deregulation may undermine the US market's earlier

trajectory towards electrical automobiles. S&P International Mobility

projections for US BEV gross sales by 2030 have been revised downward

from over 6.5 million automobiles yearly to only 5 million. This

would imply BEVs would account for less than about 30% of the US market,

far under the beforehand anticipated 40%.

With much less regulatory strain, automakers might sluggish their EV

transitions, doubtlessly stalling the momentum that had constructed up in

the {industry}.

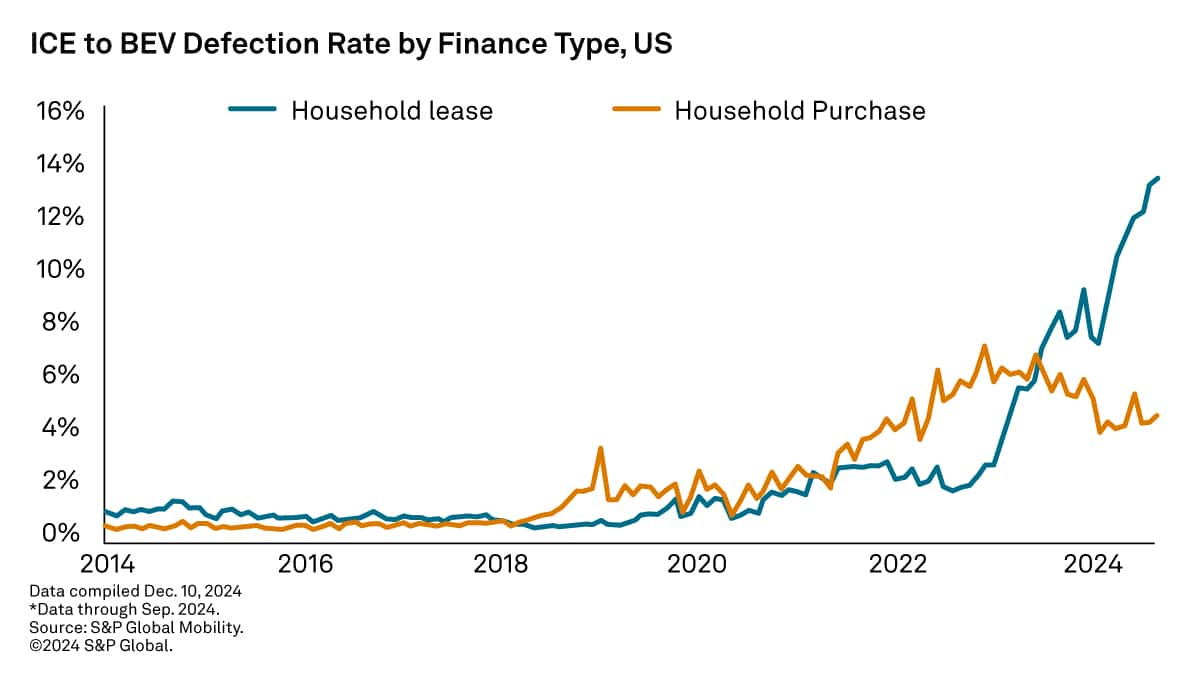

Past regulatory modifications, the lack of client incentives for

BEVs may considerably hinder BEV gross sales. One specific space of

concern is the “lease loophole” within the Inflation Discount Act,

which permits customers to lease electrical automobiles at extra

reasonably priced charges, even when they don't qualify for buy tax

credit.

If this loophole is focused for elimination, or if general

incentives are lowered, it may make BEVs even much less accessible,

particularly as producers might not have the identical incentive to

drive down costs or ramp up manufacturing.

The Broader International Affect on EVs

Along with the influence in North America, the worldwide outlook

for BEVs shall be influenced by a number of geopolitical and financial

elements. In Europe, the place the automotive market is extremely dependent

on export development, the outlook is modest, with anticipated

year-over-year development of simply 1% in 2025.

This development is being constrained by commerce points, together with

Chinese language car tariffs, and the rising prices of subsidies for

BEVs. A number of European nations have already suspended BEV

incentives to scale back authorities expenditures, which may sluggish the

shift towards electrification.

With Europe's Massive 5 markets (Germany, France, the U.Ok.,

Italy, and Spain) accounting for roughly 65% of auto quantity in

the area, any dip in client incentives may have far-reaching

results on EV adoption.

In the meantime, China's car market is seeing an rising shift

in the direction of home electrical car producers. Western OEMs are

struggling to keep up competitiveness as China-owned producers

give attention to cost-effective new power automobiles (NEVs).

Throughout the general automotive market in China, by the tip of

2024, Western automakers will account for lower than 38% of whole

gross sales. This can be a stark decline from over 60% previous to the COVID

pandemic. The expiration of client incentives in late 2024 is

prone to influence demand in China, however the market is anticipated to

rebound in 2025, with a modest 4% development forecast.

The Street Forward: International Uncertainty

The worldwide automotive {industry} is dealing with a interval of great

uncertainty because it navigates the implications of a second Trump

administration. In North America, tax cuts, rising rates of interest,

and commerce disruptions by way of tariffs will create an setting

the place car affordability could also be compromised, even because the economic system

reveals indicators of modest development.

In the meantime, the doable rollback of EV incentives and

environmental laws may sluggish the adoption of electrical

automobiles, undermining efforts to shift towards a extra sustainable

automotive future.

Throughout the Atlantic, Europe's automotive sector faces sluggish

development and potential tariff points, whereas China's market is

more and more dominated by native producers. Consequently, world

BEV gross sales projections have been adjusted downward, and automakers

might face stiffer competitors in each conventional and electrical

car segments.

On this setting, the following few years shall be crucial for

automakers to adapt to shifting commerce insurance policies, regulatory modifications,

and client behaviors. The automotive {industry}'s world transition

to electrical automobiles is way from assured, and any delays or

disruptions could have ripple results throughout markets worldwide.

Navigating these modifications requires agility and foresight, because the

{industry} continues to grapple with each challenges and

alternatives in an ever-changing geopolitical panorama.

Need assistance planning for an unsure future? Entry

our industry-best information and consulting companies with our 2025

state of affairs planning workshops.

Inquire about S&P International

Mobility's eventualities workshops