Hearken to this Gas for Thought podcast

The brand new EU tariffs

Following within the footsteps of the US, Canada and different markets,

on Oct. 30, 2024, the EU imposed countervailing duties on battery

electrical passenger automobiles imported from China. This resolution follows

a 13-month European Fee anti-subsidy investigation, which

discovered that the battery electrical car (BEV) worth chain in China

“advantages from unfair subsidization which is inflicting menace of

financial damage to EU producers of BEVs.”

The EU is making use of these new tariffs — on high of

pre-existing EU car import duties of 10% — primarily based on every

producer's contribution to the investigation and the assist

they’re thought to have benefited from. Of the three sampled

Chinese language exporters, BYD Auto has a tariff of 17%, Geely Group's is

18.8% and SAIC Group's is 35.3%. Different collaborating corporations have

a 20.7% responsibility, though they will request an accelerated evaluate to

set up a person fee.

This course of is much like what Tesla already requested, which

resulted in its tariff fee of seven.8%. Tariffs for non-cooperating

corporations are 35.3%. These tariffs shall be in pressure for 5 years,

till the top of October 2029, until the EU chooses to finish them

sooner.

Potential alternate options to tariffs

The EU and China are negotiating alternate options to tariffs. One

resolution is a “value endeavor,” which might set a minimal value

for imports. The China Chamber of Commerce for Import and Export of

Equipment and Digital Merchandise initially proposed this resolution

on behalf of 12 exporting automakers, whereas three exporters have

additionally put ahead different value undertakings. Nonetheless, the

European Fee mentioned in its last dedication {that a} “value

endeavor supply should be sufficient to eradicate the injurious

impact of the subsidies and its acceptance should not be thought of

impractical,” and it is a bar that the proposals did not

meet.

China's response

China can also be pulling different levers to finish the tariffs. In

November 2024, China filed a dispute criticism to the World Commerce

Group.

China has additionally began to use, or is contemplating making use of,

tariffs to merchandise exported from the EU to China. It has warned

that it may increase the tariffs utilized to imported passenger automobiles

which have giant displacement inner combustion engines (ICEs).

China can also be seeking to apply tariffs to different merchandise, together with

EU-sourced cognac, pork and dairy.

Our forecast

Because the European Fee formally launched — however did

not act on — provisional tariffs in July, S&P International

Mobility has made changes to its gross sales forecast for EU27

markets that partly replicate the impression these measures will

have.

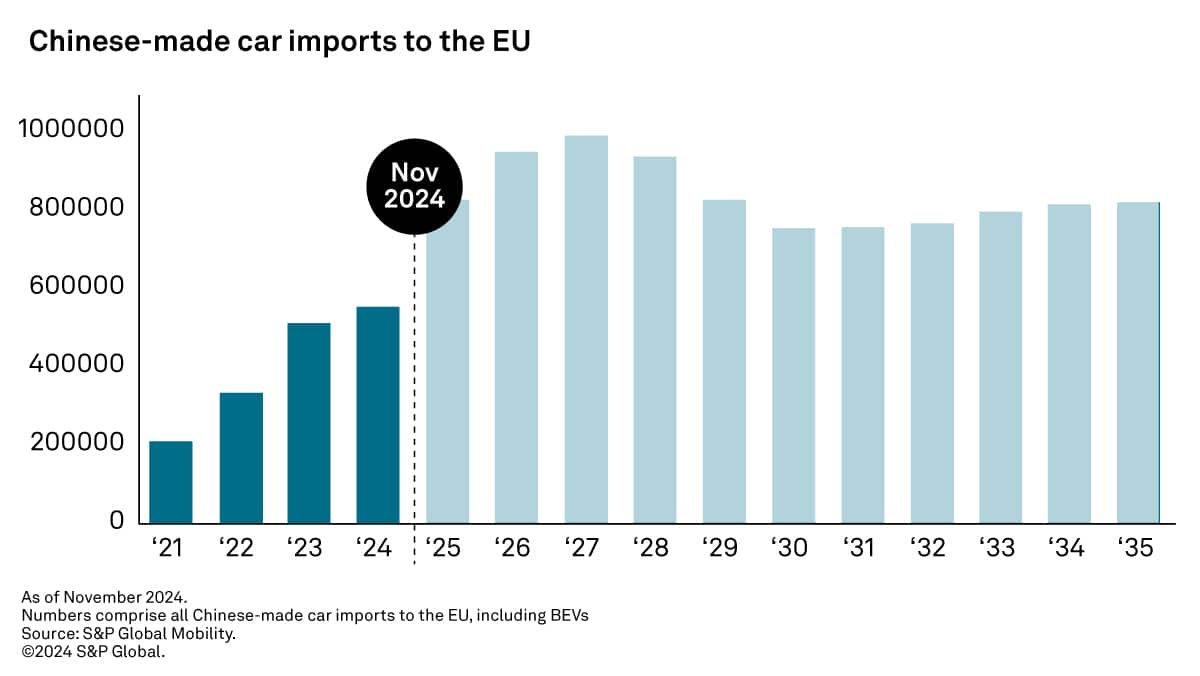

Whereas we nonetheless anticipate gross sales volumes of imported Chinese language

passenger automobiles to proceed to develop on this area over the subsequent few

years, we have now adjusted the forecast volumes downward in comparison with

our June gross sales forecast, earlier than the EU introduced preliminary

tariffs. Our registration forecast for Chinese language-made passenger automobiles

in EU27 now stands at round 550,100 models. Though this determine is

down from our earlier expectations, it is going to nonetheless be an enchancment

over 2023 by 8.1%.

We’re adjusting our forecast for Chinese language-built passenger automobiles

registered in EU27 past 2024. In S&P International Mobility's

Gentle Car Gross sales forecast for November, the gross sales ramp-up

from 2025 to 2027 is predicted to lower once more. Tariffs will

forestall China-built passenger automotive gross sales within the EU27 from reaching

the beforehand forecasted peak of 1 million models within the second

half of the last decade.

The forecast volumes above embrace not solely automobiles from

Chinese language manufacturers but additionally passenger automobiles constructed by non-Chinese language

automakers. These corporations — together with Tesla, Renault Group,

VW Group, BMW Group, Honda, Mazda and Toyota — import automobiles

into EU27 from their manufacturing websites in China.

How automakers are responding

Past the impression of tariffs on BEVs, a key motive for the

decline of imported Chinese language-built passenger automobiles to the EU27 is

non-Chinese language producers' plans to maneuver manufacturing of some

Chinese language-assembled merchandise to Europe towards the top of the last decade.

This transfer would come with the Volvo EX30, which shall be moved to a

facility in Belgium, and the brand new technology battery electrical Mini

Cooper and Aceman, which shall be made within the UK.

Chinese language automakers have additionally taken steps to maneuver manufacturing to

EU27 or the encircling areas. BYD plans to open manufacturing websites

in Hungary and Turkey throughout the subsequent three years, however different

Chinese language automakers' plans to make investments within the EU have

cooled. This can be linked to experiences that the Chinese language authorities

is placing strain on its car producers to pause searches for

websites within the area and never signal new offers as negotiations about

the tariffs proceed. These regarded as doing so embrace Chery

Auto, Chongqing Changan Car and Dongfeng Motor Group.

However, the door seems to stay open for Chinese language

car producers to construct meeting vegetation in Turkey, the place guidelines

permit them to keep away from some import tariffs by making native

investments. Because of a customs union—an settlement to

eradicate tariffs — between Turkey and the EU, these

investments may permit Turkey to function an export hub to the EU

for Chinese language automakers. BYD, SAIC Group and Chery have been linked

with Turkish manufacturing funding.

Regardless of the tariffs on BEVs, a number of components will come into play

that counsel the impression on Chinese language passenger automotive imports won’t

be as vital because it may have been. For instance, S&P

International Mobility expects that Chinese language manufacturers will exchange a few of

the decreased BEV imports to the EU with extra imports of ICEs,

hybrids and plug-in hybrids.

On the similar time, Chinese language manufacturers' pricing methods could have

allowed them to deal with among the elevated prices regardless of tariffs.

Our evaluation means that the on-the-road value discrepancy for

some fashions in China vs. in EU27, particularly that seen by Chinese language

manufacturers, is unlikely to be solely because of the 10% import tariff and

transport prices and extra prone to OEMs selecting to have greater

costs as a part of their EU27 market technique.

However, there shall be different knock-on results from having

fewer Chinese language BEV imports to the EU. There could possibly be fewer BEVs

general registered within the EU, particularly if some clients are not any

longer concerned with switching as a result of the Chinese language-made merchandise

don't enchantment to them anymore. On the similar time, these clients

may additionally exchange present automobiles with non-BEVs from China or

elsewhere. This may gradual the expansion of BEVs within the EU27 market

and run counter to the European Fee's present carbon dioxide

discount targets.

Get up to date forecast by 2028: EU BEV Gross sales (Imported from

China)

Subscribe to our Gas for Thought publication