The string of weak information and the continued enchancment in pricing stress have prompted the Federal Reserve to cast off its hawkish tone and sign {that a} price lower could also be imminent. Come September, most market strategists see the central financial institution starting to reverse its price hikes and the rally broadening out.

A charting specialist and YouTuber drew upon historical past to counsel that the market might not fare nicely within the months following a price lower.

What Occurred: The primary price lower following the financial weak spot that was evident after the dot-com bubble burst was carried out on Jan. 3, 2001. The central financial institution reasoned then that the speed lower introduced at an unscheduled assembly, would assist to alleviate weakening gross sales and manufacturing and that it was completed within the context of decrease client confidence, tight situations in some segments of the monetary markets and excessive power costs, which impacted family and enterprise buying energy.

A chart shared by @ChartingProdigy confirmed the S&P 500 noticed a 3.5-week bounce following this price lower. The upward bounce got here after the market topped after which dropped by about 19.53%. The speed lower formally triggered a bear market, with the index dropping about 51% from the highest and 44.50% after the bounce that adopted the speed lower.

See Additionally: Prime Performing Small Cap Shares

When the Fed lower charges by 50 foundation factors in Sept. 2007 in an effort to forestall an aggravation within the housing market collapse, the market had an identical 3.5-week bounce. After the Sept. 18, 2007 price lower, the S&P 500 topped 3.5 weeks later. After the completion of a double-top formation, the index plummeted by over 20%. From the Fed pivot level, the index slumped 57.77%, falling deep into correction territory.

Why It’s Essential: In contrast to within the earlier two rate-cut cycles that preceded the post-COVID-19 pandemic cuts, the financial situations, although slackening, are usually not pointing to a “fall-off-the-cliff” situation. The job market has proven indicators of weak spot with the downward annual revision however has not contracted and shoppers continued to spend regardless of the rising inflation, which ate away into actual revenue.

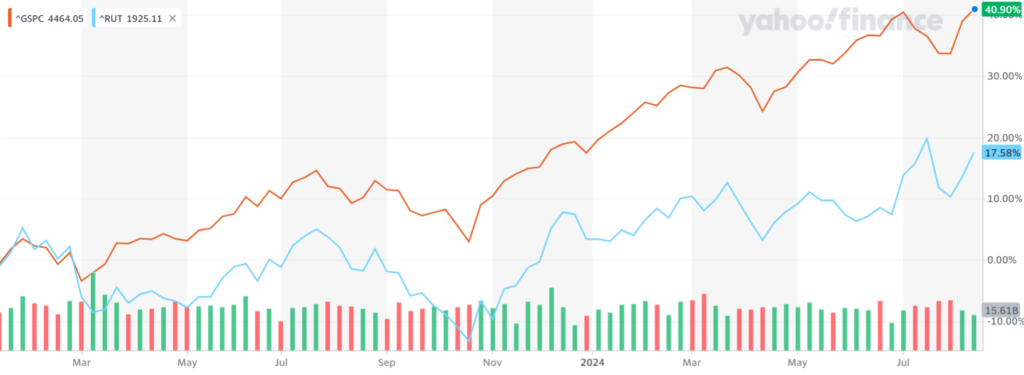

The market has been on a scintillating rally since 2023 after the downturn within the earlier week, with mega-cap shares liable for a lot of the upside.

Small-caps have lagged behind their greater friends amid the upper rate of interest setting. As inflation went previous 9% in the summertime of 2022, the Fed started to lift rates of interest starting in March 2023. Small-cap corporations are reliant on loans as a supply of financing, and better rates of interest improve their rate of interest servicing prices and in addition make credit score phrases powerful to avail loans.

Supply: Yahoo Finance

A aid rally may come if the Fed chooses to decrease charges on the Sept. 170-18 Federal Open Market Committee assembly and the way lengthy the momentum will persist is a moot level.

The SPDR S&P 500 ETF Belief SPY, an exchange-traded fund that tracks the S&P 500 Index, has added 19% for the year-to-date interval. On Friday, the ETF climbed 1.06% to $562.13, in response to Benzinga Professional information.

Learn Subsequent:

Picture By way of Shutterstock

Market Information and Information delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.