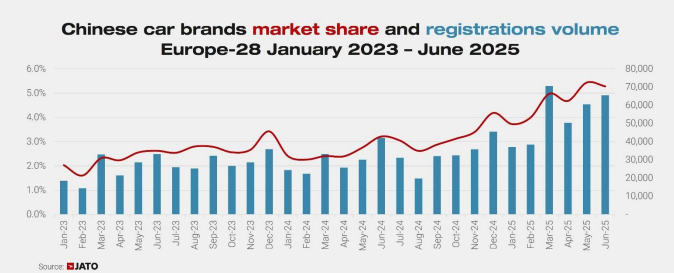

Chinese language automobile manufacturers virtually doubled their market share to five.1% and outsold manufacturers like Ford throughout Europe the primary half of the yr, based on the newest knowledge from Jato Dynamics.

As Europe’s new automobile market has shrunk, competitors has intensified, largely to the detriment of European, Japanese, Korean and American automobile manufacturers.

Chinese language automobile manufacturers elevated volumes by 91% in H1, falling simply wanting Mercedes at 5.2% share, however forward of Ford at 3.8%. Mixed, Chinese language automobile manufacturers outsold Mercedes in June.

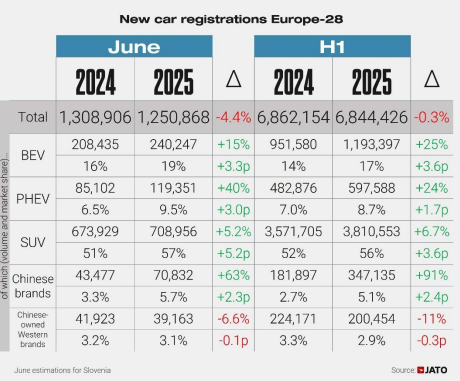

General Europe’s new automobile market went into reverse in June, as month-to-month registrations dropped by 4.4% year-on-year to 1,250,868 models.

Nonetheless, 5 unique tools producers (OEMs) particularly had been driving the speedy development for Chinese language manufacturers throughout Europe: BYD, Jaecoo, Omoda, Leapmotor and Xpeng.

BYD, which Jato mentioned has been notably aggressive in its pricing technique, registered 70,500 models in H1 2025, a year-on-year improve of 311%.

In June alone, BYD registered 15,565 models, getting into the top-selling 25 manufacturers and outselling Suzuki, Mini and Jeep.

The BYD Seal U was alongside with the Volkswagen Tiguan the top-selling PHEV in Europe in June and the third in H1.

The BYD Seal U was alongside with the Volkswagen Tiguan the top-selling PHEV in Europe in June and the third in H1.

Jaecoo and Omoda, each a part of Chery, additionally made substantial progress, though this has not been as a result of their electrical line up.

Plug-in hybrid SUVs accounted for 29% of their mixed month-to-month registrations in June, whereas conventional ICE fashions made up virtually two-thirds (63%) of the full.

The Jaecoo 7 was Europe’s ninth top-selling PHEV in June.

Leapmotor registered over 8,300 models in June alone, pushed largely by the recognition of its T03 metropolis automobile and C10 SUV.

In the meantime, Xpeng has emerged as probably the most profitable high-end Chinese language automobile model in Europe thus far in 2025, with 8,338 models registered within the first half of the yr.

Its development has been led by robust demand for the G6 SUV, which accounted for five,615 of these registrations.

Main gamers lose market share

Whereas Chinese language automobile manufacturers continued their outstanding ascent, a few of the business’s greatest gamers have conceded market share.

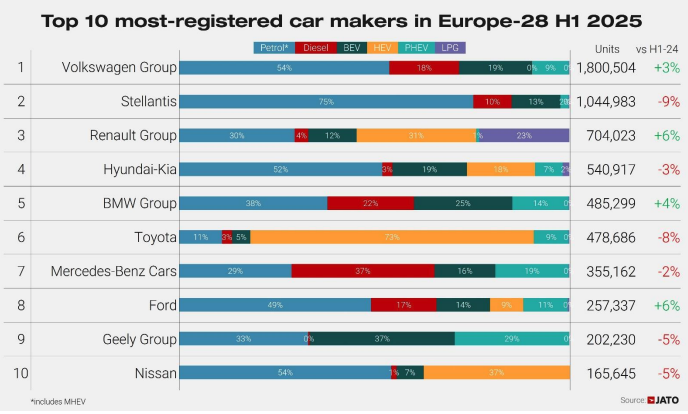

Stellantis skilled the biggest lower within the first six months of the yr, with its market share declining from 16.7% to fifteen.3% year-on-year.

In reality, the group recorded its lowest H1 registrations quantity throughout Europe-28 since its creation in 2021.

Of the ten Stellantis manufacturers out there for buy in Europe, solely three recorded development in H1 2025: Alfa Romeo (up 33%), Peugeot (up 6%) and Jeep (up 2%).

General, Stellantis noticed its volumes fall by 8.6% and 11.7% in H1 2025 and June, respectively, with Fiat, Lancia, DS, Maserati and Abarth recording steep losses. Citroen and Opel/Vauxhall additionally posted double-digit drops in registrations.

Tesla noticed second steepest decline in market share

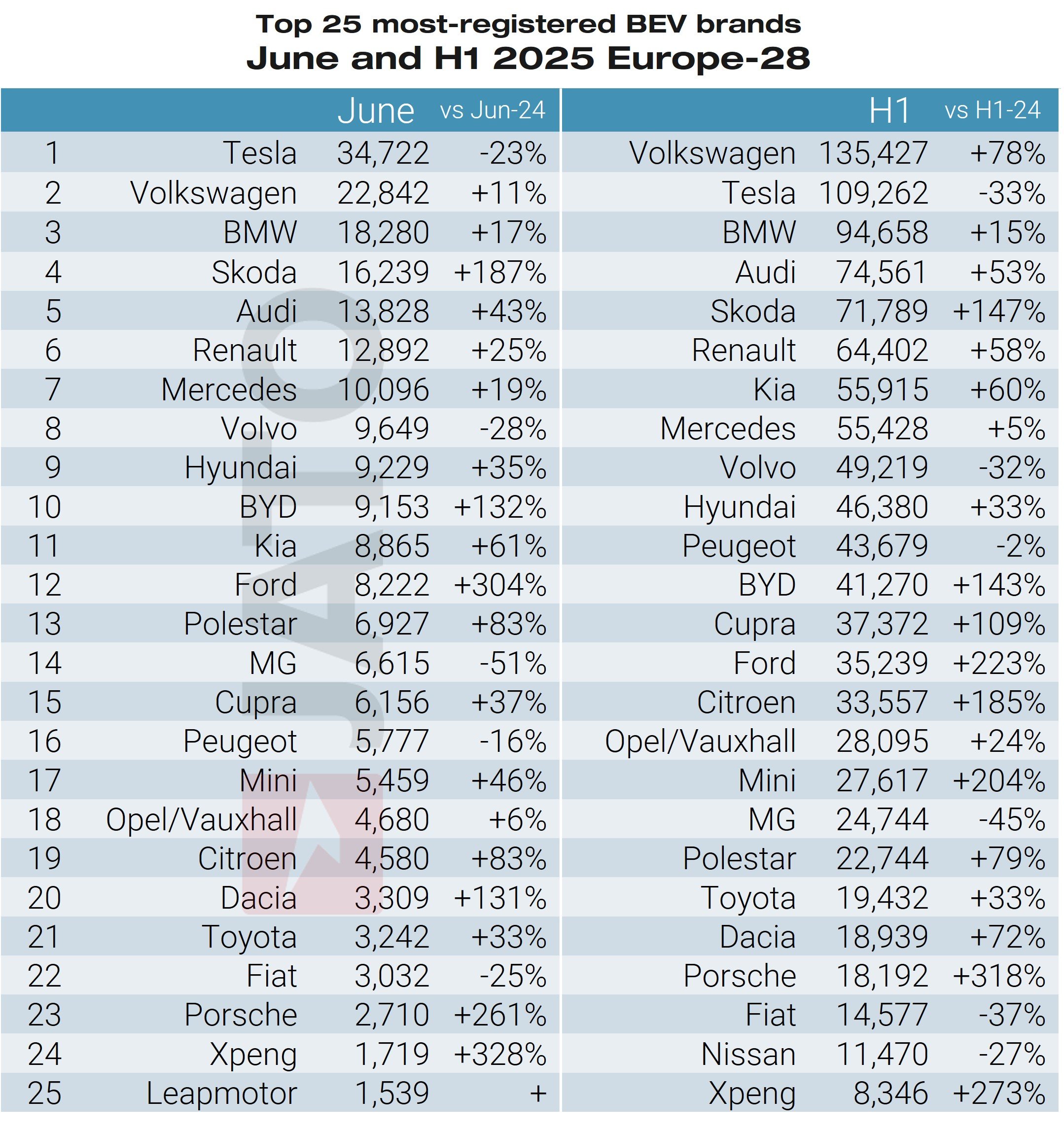

Tesla skilled the second steepest lower in market share in H1 2025, down from 2.4% in H1 2024 to 1.6%.

Over this interval, Tesla has misplaced its place within the group rankings to SAIC Motor, proprietor of MG, which outsold Tesla for the primary time.

The Chinese language carmaker elevated its volumes by 22% to 162,153 models, in comparison with a decline of 33% at Tesla to 109,264 models.

Felipe Munoz, world analyst at JATO Dynamics, mentioned: “Stellantis’ woes are a results of two elements: the failure by lots of its manufacturers to introduce new fashions, and its rising concentrate on BEVs, usually costlier than ICE fashions within the new automobile market.

“The up to date Tesla Mannequin Y has thus far failed to offer the anticipated gross sales enhance for the model.

“On the identical time, competitors from BYD and Volkswagen Group is making it tougher for Tesla to take care of its management place.”

Whereas Tesla was Europe’s second most registered BEV maker in June, it occupied fourth place within the H1 BEV rankings, behind Volkswagen Group (28% share), Stellantis (11%) and BMW Group (10.3%).

BEVs surpass the a million models mark for the primary time

The battery electrical car (BEV) phase was a shiny spot in Europe’s new automobile market with registrations exceeding the a million models mark for the primary time within the first half of the yr.

In whole, 1,193,397 models had been registered, up by 25% year-on-year.

Nonetheless, regardless of the optimistic trajectory, development slowed in June with registrations rising by 15% to 240,247 models.

BEVs accounted for 17.4% of Europe’s new automobile market within the first half of 2025, a rise of three.6 share factors in comparison with the identical interval final yr.

As a phase, BEVs proceed to develop in significance for many of Europe’s greatest carmakers.

JATO Dynamics’ knowledge reveals that, excluding Tesla, BYD is the OEM most depending on the phase, which signify virtually two-thirds (64%) of its whole gross sales combine.

Nonetheless, just like SAIC, which noticed its BEV share drop to fifteen.4%, BYD’s BEV share has declined in comparison with H1 2024.

This shift displays a strategic pivot towards different powertrains, as each producers sought to mitigate the impression of tariffs imposed on their BEVs.

In distinction, Ford noticed a notable improve, with BEVs rising from 4.5% of its gross sales in H1 2024 to 13.7% in H1 2025.

Volkswagen Group’s BEV share grew from 10.1% to 18.7% over the identical interval, whereas Hyundai-Kia noticed a rise from 12.6% to 19.1%.

Progress was additionally recorded at BMW Group and Renault Group, with extra modest beneficial properties noticed at Stellantis, Toyota, and Mercedes-Benz.

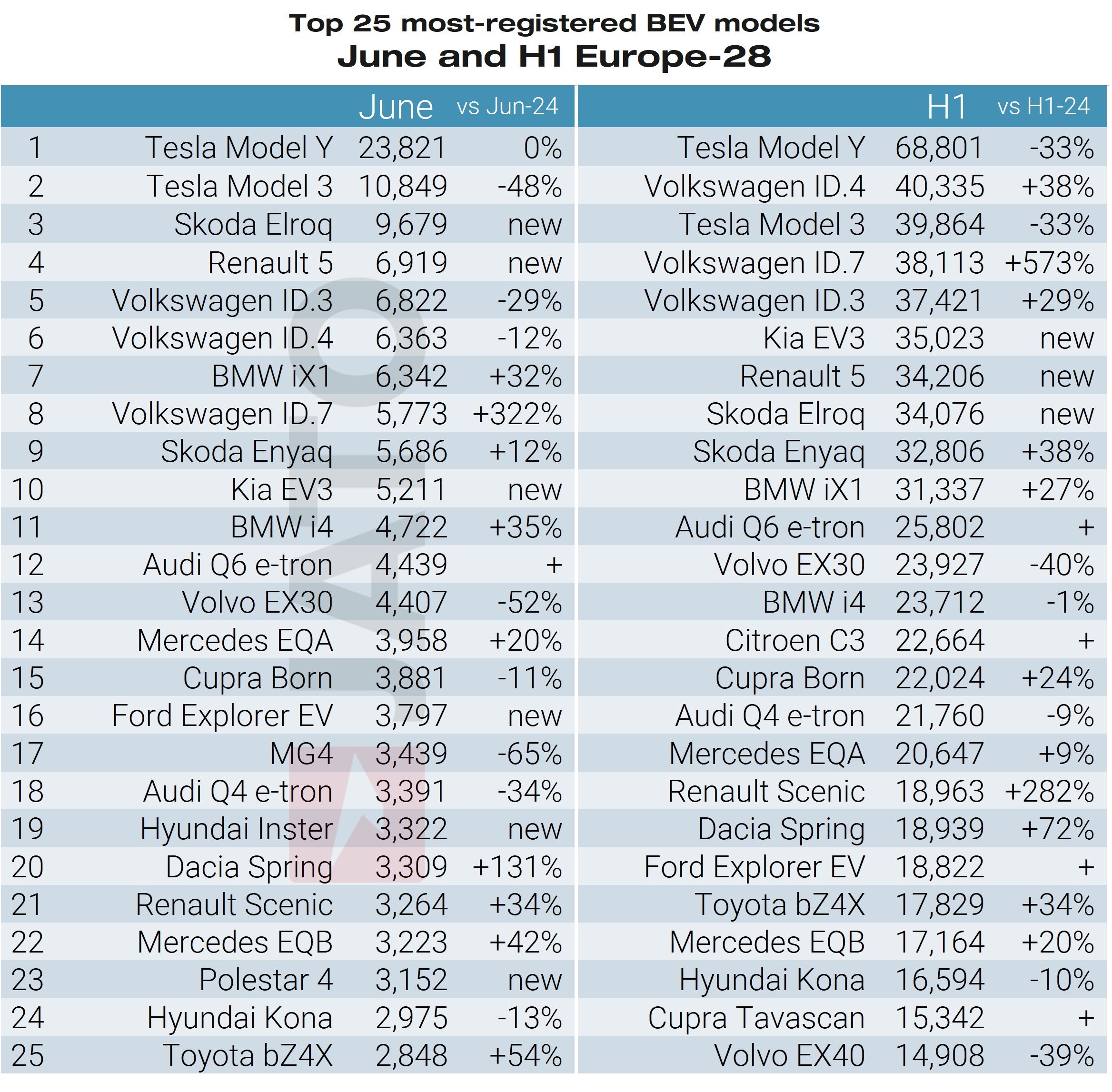

Tesla nonetheless tops BEV mannequin gross sales rankings

Mannequin-wise, and regardless of the challenges, the Tesla Mannequin Y was as soon as once more Europe’s prime promoting BEV in each June and H1 2025.

June was the primary month this yr wherein Mannequin Y registrations didn’t decline.

Though the improve was minimal (up 0.1% vs. June 2024), it onfirmed the pattern that started in Might, when volumes fell by simply 7%.

This marked a vital enchancment in comparison with the common month-to-month drop of fifty% recorded between January and April.

Renault Group tops general mannequin rankings

Renault Group topped the mannequin rankings in each June and the primary half of 2025.

Greater than 27,200 models of the Renault Clio had been registered in June, over 3,000 greater than the Tesla Mannequin Y, which ranked second with greater than 23,800 models registered through the month.

Over the primary six months of the yr, the Renault Clio was surpassed solely by the Dacia Sandero, one other mannequin from throughout the Renault Group portfolio.

Among the many large month-to-month winners throughout June had been the Clio (up 19%), Peugeot 208 (up 16%) and Opel/Vauxhall Corsa (up 12%).