By Greg Genette, Analyst, Technical Analysis and

Andrej Divis, Analysis and Evaluation Govt

Director

Potential adjustments to the US authorities starting in 2025 will

doubtless form the way forward for US local weather insurance policies, as leaders maintain

differing views on local weather motion and main coverage milestones

strategy. The manager and congressional make-up shall be essential,

with Republicans doubtless pushing for vital adjustments within the

coverage surroundings and Democrats favoring continuity.

This evaluation will discover potential impacts on the medium and

heavy industrial car (MHCV) market, notably autos above 6.0

metric tons and roughly equal to US Courses 4-8.

The place we stand at present: Assessing the present

surroundings

The present US trucking market could be categorized into two key

areas: First, the financial system and truck demand, and second, coverage and

electrification. Our baseline forecast anticipates a modest

improve out there general and within the zero-emission section.

With labor circumstances loosening and inflation moderating, the US

Federal Reserve is anticipated to proceed slicing rates of interest in

2024, boosting truck demand after a interval of over-capacity and

weak provider profitability.

Truck gross sales are predicted to stay flat in 2024, however momentum

is anticipated to construct towards a record-setting 2026 due to

improved financial circumstances and the temptation to purchase forward of

2027 diesel-truck emissions adjustments. On the regulatory and coverage

entrance, California’s Superior Clear Vans rule and the federal

Greenhouse Fuel Section 3 emission rules will form the

business’s adoption of electrified autos via the midterm. We

imagine the following 36 months are a crucial make-or-break interval for

business zero-emission car (ZEV) objectives and aspirations. The

incoming presidential administration can have the chance to

form the power transition and the trajectory of general new truck

demand.

Trucking via 2024: Evaluating potential

impacts

The potential impacts of a change in authorities could be

categorized and evaluated below the identical two areas described

beforehand: the financial system and truck demand, and coverage and

electrification.

Financial development and demand for brand spanking new vehicles might face two

new realities with a brand new administration taking workplace subsequent

yr. There are two main pathways that might shift the prevailing

market demand forecast, primarily via new tariffs. The primary

state of affairs predicts greater truck gross sales if the financial system exceeds

expectations, with decrease inflation, rate of interest cuts and sturdy

shopper spending boosting demand past ranges anticipated in our

baseline for 2025 and 2026.

Conversely, a second state of affairs anticipates decrease truck gross sales due

to unfavourable financial components, together with a possible commerce warfare,

rising tariffs and decreased shopper confidence, impacting general

financial efficiency and street freight developments. Beneath the floor,

additionally it is essential to notice that new tariffs might instantly hinder

the adoption of electrified industrial autos, relying on the

particulars. A lot of the battery provide chain relies in mainland

China, offering a price benefit. Though efforts to localize

battery manufacturing and different crucial elements are ongoing,

the US continues to be years away from finishing this transition. Greater

tariffs might discourage consumers by elevating costs, additional slowing

the power transition in trucking, and it’s not clear that such

insurance policies can be related to simply one of many presidential

candidates.

In abstract, from an financial and new truck demand perspective,

the important thing issue to look at concerning the affect of the brand new

administration on the broad truck market is the extent to which new

tariffs could also be imposed, affecting macroeconomic indicators, new

truck demand and the prices of electrical car elements and

batteries.

Underneath a brand new administration, rules and the

prospects for electrification might face a fancy new

future. Underneath present market circumstances, zero-emission

vehicles stay comparatively costly for a lot of truck vocations

(purposes) relative to a diesel truck, particularly with out

incentives. Subsequently, our forecast assumes that stringent

rules would be the main demand driver for zero-emission

vehicles via the late 2020s and into the 2030s. A shift to

Republican management is extra more likely to considerably change the

regulatory panorama for trucking within the US, introducing

uncertainty and threat to our zero-emission car forecast. The

following paragraphs will discover potential eventualities and their

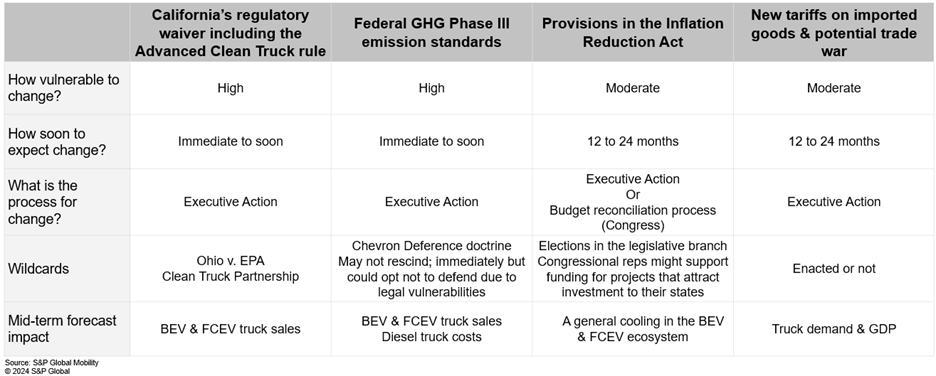

impression on our powertrain forecast. We’ll give attention to three key

subjects: California’s regulatory waiver, the federal Greenhouse Fuel

Section 3 requirements and the Inflation Discount Act.

California’s regulation waiver:

California’s authority to set its personal car emissions

requirements, granted below the Clear Air Act, was revoked by the

Trump administration in 2019 however reinstated by President Biden,

which enabled California’s latest Superior Clear Truck (ACT)

regulation.

One other revocation is one threat below a brand new administration, however

not the one threat on this time interval. A pending Supreme Court docket

case, Ohio v. EPA, might problem California’s waiver, doubtlessly

disrupting these guidelines and including a component of uncertainty to the

way forward for this regulation, no matter administration. Nevertheless,

many truck producers have dedicated to following the Superior

Clear Truck rule no matter authorized outcomes, in what they’re

calling the Clear Truck Partnership, decreasing the chance of main

adjustments to market circumstances.

In abstract, utterly eliminating this rule would considerably

decrease our zero-emission car forecast. Nevertheless, for this to

turn out to be actuality, a number of uncertainties would must be

resolved.

Greenhouse Fuel Section 3:

The Greenhouse Fuel (GHG) Section 3 regulation, set to start in

2027, mandates progressively stricter CO2 requirements for

medium and heavy industrial autos via 2032. Though it does

not require the sale of ZEVs, it does encourage not directly them

via the tightness of the requirements.

We count on a Democratic administration to maintain this regulation in

place and maybe lengthen and tighten these emissions guidelines past

2032. A Republican administration could also be extra open to listening to

critics of the measure and maybe rescind and weaken these

requirements, doubtlessly delaying their enforcement.

In the meantime, the Supreme Court docket’s ruling towards Chevron Deference

might result in elevated authorized challenges towards EPA rules,

including additional uncertainty to the trucking business and the long run

pathway for GHG rules. Adjustments to delay or reduce GHG

requirements are more likely to diminish our outlook for zero-emission

truck adoption, significantly within the late 2020s and early 2030s.

The Inflation Discount Act:

The Inflation Discount Act (IRA), handed in 2022, allotted

$369 billion for local weather and clear power, together with a number of key

investments for decarbonizing trucking. The IRA notably supplied up

to $40,000 in tax credit for clear industrial car purchases,

in addition to incentives for infrastructure and clear hydrogen.

Whereas a brand new administration could modify components of the IRA, a full

repeal is unlikely, as a result of legislative course of required to do

so and as a result of help for numerous components of the laws from

throughout the political panorama. Even so, the $40,000 tax credit score is

not anticipated to considerably speed up zero-emission truck

adoption within the close to time period owing to excessive prices and operational

challenges.

Conclusion

Underneath a Republican administration the next have the

potential to alter:

A brand new authorities in 2025 might considerably impression the US

trucking business by reshaping tariffs, rules and local weather

insurance policies. Potential adjustments like revising California’s emissions

waiver, rescinding and redrafting federal GHG Section 3 requirements,

and modifying provisions of the Inflation Discount Act might

doubtlessly gradual electrical truck and bus adoption. The timeline for

these adjustments, particularly inside the first 100 days, stays

unsure. Key wildcards just like the Ohio v. EPA case, the overturning

of Chevron Deference, and election outcomes in Congress might

additional affect regulatory changes on this extremely regulated

and economically delicate business.

Obtain our free MHCV forecast by area.

Study extra about our industrial car options.

This text was revealed by S&P World Mobility and never by S&P World Scores, which is a individually managed division of S&P World.