The battle over client spending on meals and home items continues to warmth up and big-box retailers could also be taking extra market share from greenback shops throughout a number of classes.

What Occurred: Low cost retailer Greenback Basic Corp DG lately reported second-quarter monetary outcomes that noticed income and earnings per share each miss estimates from analysts.

The corporate additionally lowered its full-year income and earnings per share outlook as the corporate could also be dropping market share to bigger rivals Walmart Inc WMT and Goal Corp TGT.

Greenback Basic was requested about competitors throughout its second-quarter convention name.

“We essentially do not consider in any respect that the mannequin is structurally challenged. However there are challenges to the enterprise as this quarter indicated,” Greenback Basic CEO Todd Vasos mentioned.

Vasos mentioned the corporate is gaining market share from new retailer openings. The CEO dismissed issues of competitors and positioned the blame on the weaker than anticipated quarter on the monetary constraint of the corporate’s core buyer who makes below $35,000 yearly.

“What we additionally noticed was that whereas we’re not dropping share, we’re truly gaining share towards all lessons of commerce within the consumable realm.”

Vasos mentioned the corporate isn’t seeing any competitor take Greenback Basic’s core buyer.

“We proceed to really feel superb about our on a regular basis low-price place relative to rivals and different lessons of commerce.”

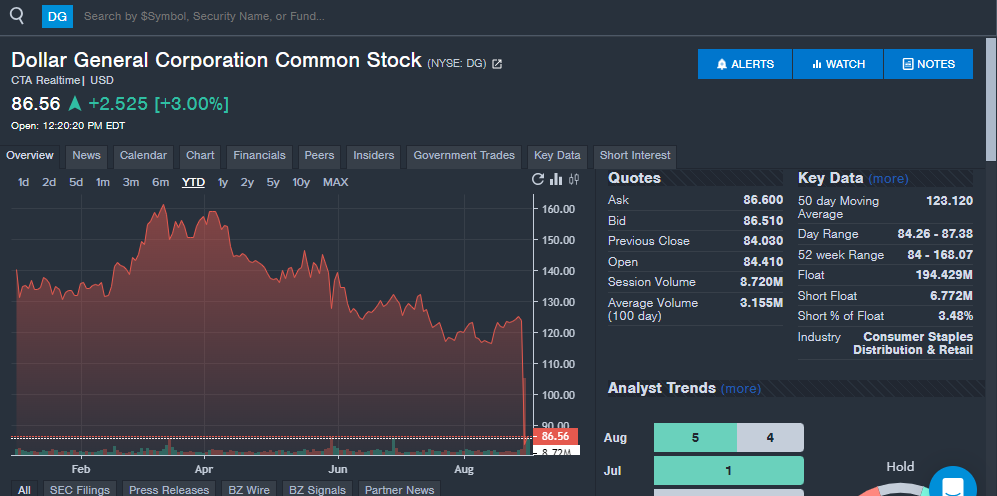

Greenback Basic shares commerce at $86.43 versus a 52-week buying and selling vary of $83.76 to $151.22. Greenback Basic inventory is down 38.5% year-to-date as seen on the Benzinga Professional chart under.

Learn Additionally: Greenback Basic Says Majority Of Folks Who Store There ‘Really feel Worse Off Financially’ In contrast With 6 Months In the past Amid Worth Hikes, Softer Employment Ranges

Walmart, Goal Profitable: Walmart and Goal have each lately reported monetary outcomes and proven energy of client spending.

Walmart beat income and earnings per share estimates from analysts. The corporate additionally raised full yr monetary steerage. Walmart reported a 4.2% enhance in U.S. identical retailer gross sales.

A number of analysts highlighted the outcomes exhibiting Walmart successful market share throughout a number of revenue ranges, which may point out taking market share from the core greenback retailer buyer.

Goal additionally beat income and earnings per share estimates from analysts in its lately reported quarter.

Each Walmart and Goal have expanded their product assortments and are specializing in the buyer who continues to be impacted by above common inflation. Each retailers are leaning into non-public label manufacturers which have cheaper value factors and on increasing decrease price choices throughout a wide range of product classes.

Whereas Greenback Basic is not fearful about competitors, the outcomes from Walmart and Goal would possibly say in any other case.

Walmart shares commerce at $76.59 versus a 52-week buying and selling vary of $49.85 to $76.75. Walmart inventory is up 44% year-to-date in 2024.

Goal shares commerce at $152.77 versus a 52-week buying and selling vary of $102.93 to $181.86. Goal inventory is up 7% year-to-date in 2024.

Greenback Tree Up Subsequent: Low cost retailer Greenback Tree Inc DLTR, which owns the namesake Greenback Tree model together with Household Greenback, may proceed for instance the market share losses for greenback shops to big-box retailers.

Greenback Tree stories second-quarter monetary outcomes on Wednesday, Sept. 4. Analysts count on the corporate to report earnings of $1.04 per share and income of $7.49 billion in line with information from Benzinga Professional.

The corporate reported earnings of 91 cents and income of $7.33 billion in final yr’s second quarter. Analysts see each figures growing for this yr. The earnings report may present whether or not Greenback Tree is seeing elevated competitors from different retailers.

Buyers and analysts could pay specific consideration to the convention name when questions on competitors may come up. The corporate’s commentary on market share, competitors and core clients may present whether or not Walmart and Goal are main issues for the retailer.

Greenback Tree has missed earnings estimates from analysts in three of the final 5 quarters and beat income estimates in three of the final 5 quarters.

Greenback Tree shares commerce at $84.29 versus a 52-week buying and selling vary of $83.76 to $151.22. Greenback Tree inventory is down 41% year-to-date in 2024.

Learn Subsequent:

Market Information and Knowledge dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.