Mine or stake? It’s time to choose.

Consensus mechanisms like proof of labor (PoW) and proof of stake (PoS) are the core parts that hyperlink blockchain know-how collectively. They tackle the challenges of belief and safety in decentralized environments and create a means for customers to succeed in an settlement on conduct.

Each PoW and PoS assist to judiciously determine the state of the community, keep away from double spending, and keep the integrity of blockchain transactions.

Proof of labor vs. proof of stake: what’s the distinction?

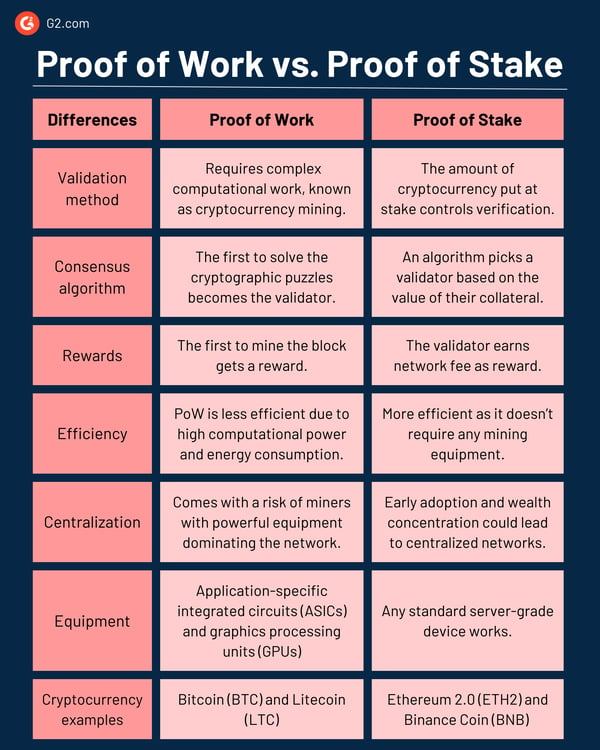

Proof of Work (PoW) and Proof of Stake (PoS) are strategies used to safe and validate blockchains. The selection between PoW and PoS depends upon particular wants. PoW depends on miners competing to unravel puzzles, whereas PoS selects validators primarily based on staked cryptocurrency. PoW affords robust safety however is energy-intensive. PoS is quicker and extra environment friendly, however safety depends upon stake distribution.

Consider PoW as a race the place members compete towards one another to win. PoS, alternatively, is extra like a voting system the place people with the best stake have a greater probability of successful.

Whatever the methodology, community members should use cryptocurrency wallets to handle and safe their block rewards and validation incentives.

Proof of labor vs. proof of stake: overview

Each PoW and PoS have a devoted house on the planet of cryptocurrencies and blockchains. The ultimate selection of consensus mechanism relies upon fully on the objectives of every blockchain community and its neighborhood’s preferences.

As the unique consensus mechanism, PoW is usually favored for its safety and confirmed reliability. PoS is chosen for its scalability advantages and diminished environmental influence. Some blockchain networks go for hybrid fashions.

This detailed overview offers you extra data for additional consideration.

However how do blockchain customers select what aligns greatest with their priorities? Let’s discover out.

What’s proof of labor?

The Bitcoin community first applied proof of labor in 2009, paving the way in which for different cryptocurrencies. The decentralized nature of PoW permits anybody with the required gear to take part in mining. PoW grew to become the primary broadly used consensus mechanism to validate cryptocurrency transactions with out counting on a 3rd get together.

Beneath PoW, all of the computer systems or nodes in a community compete with one another to unravel advanced cryptographic puzzles, a course of we name cryptocurrency mining. The quickest miner provides new blocks to the blockchain and receives the newly minted digital forex and transaction charges as incentives.

Examples of cryptocurrencies utilizing PoW

A number of blockchain networks and cryptocurrencies use proof of labor, together with:

- Bitcoin (BTC) was the primary cryptocurrency to embrace PoW for Bitcoin mining.

- Litecoin (LTC), launched in 2011 by Charlie Lee, makes use of a PoW mechanism referred to as Scrypt.

- Monero (XMR) and its privacy-enhancing applied sciences increase the anonymity of blockchain customers.

- Zcash (ZEC) relies on Bitcoin’s codebase and has a rep for its cryptographic privateness methods.

- Dogecoin (DOGE) was invented as a joke primarily based on the well-known meme. Nonetheless, as soon as it gained reputation, it developed right into a reputable cryptocurrency with an energetic person base.

Proof of labor professionals

PoW affords a strong strategy to securing decentralized programs like blockchains. Its dependence on computational work and incentives guarantees a excessive stage of belief on the planet of cryptocurrencies. The advantages under additionally make PoW a go-to selection amongst miners.

- Decentralization. PoW has a broad distribution of community energy since anybody with the required gear can use it to take part in mining. Plus, Bitcoin has been utilizing PoW for over a decade, which makes it dependable and secure.

- Block rewards. The reward mechanism of PoW incentivizes miners to contribute their computational energy to safe the community. This helps keep the integrity of the blockchain.

- Unchangeable data. As soon as the transactions are validated and added to the blockchain, it’s troublesome to change them with out placing in excessive ranges of computational work. Historic data are unchangeable beneath PoW, making certain belief in knowledge.

- Excessive-security threshold. Any malicious assaults beneath PoW require management of 51% computational energy of the community, making it extraordinarily unlikely for a foul actor to launch such a expensive assault.

Proof of labor cons

Because the PoW community continues to develop and the time concerned in fixing puzzles will increase, customers are sure to face slower transaction processing occasions. It additionally comes with different challenges, comparable to:

- Vitality value and consumption. Whereas PoW is very safe resulting from its resource-intensive nature, it consumes important quantities of computational vitality. It contributes to the carbon footprint of many cryptocurrencies.

- {Hardware} centralization. PoW requires specialised {hardware} for mining, which suggests it’s simpler for individuals with extra assets to dominate the community. This undermines the decentralization precept of blockchain.

- Digital waste. Miners should hold changing older gear with one thing newer and extra environment friendly with a purpose to keep on monitor with the evolution of cryptocurrency mining software program. A ton of electrical waste is left behind.

What’s proof of stake?

Contemplating the inefficiencies PoW got here with, establishing a sustainable consensus mechanism was the necessity of the hour. Consequently, a brand new energy-efficient methodology referred to as proof of stake was launched in 2011.

In contrast to PoW, which had a aggressive validation course of, PoS selected validators primarily based on the quantity of cryptocurrency they held and their willingness to “stake” as collateral. The upper the stake, the upper the possibilities of being chosen so as to add the brand new block of transactions to the ledger. Merely put, a cryptocurrency proprietor must personal essentially the most native crypto cash on a blockchain to be chosen as a validator.

Examples of cryptocurrencies that use PoS

Since PoS doesn’t require excessive computational energy or vitality consumption, many cryptocurrencies desire it over PoW. A number of examples embrace:

- Ethereum (ETH) was initially on PoW however transitioned to PoS in September 2022 as Ethereum 2.0 (ETH2). The change improved scalability, vitality effectivity, and safety.

- Cardano (ADA) is a public blockchain platform famend for its scalability options and research-driven improvement.

- Polkadot (DOT) makes use of a singular variation of PoS referred to as nominated proof of stake (NPos) that allows totally different blockchains to speak and work collectively.

- Binance Coin (BNB), one of many largest cryptocurrencies on the planet, powers your complete Binance chain ecosystem.

- Avalanche (AVAX) is a decentralized open-source blockchain that emphasizes quick transaction finality and scalability.

Proof of stake professionals

PoS has change into a broadly used consensus mechanism in comparison with its energy-intensive different, PoW. It affords many different advantages, like:

- Much less centralization. As a result of validators are chosen solely primarily based on the quantity of cryptocurrency they’re prepared to stake. PoS reduces the chance of enormous mining swimming pools coming in and dominating networks.

- Ease of scalability. PoS is extra scalable as in comparison with PoW as a result of it makes use of much less vitality. The validation course of isn’t depending on computational energy. So all of the elevated community exercise faces no congestion, and transaction processing stays as quick as ever.

- Decreased {hardware} bills. PoS doesn’t have any recurring bills as a result of it doesn’t want mining gear. It additionally lowers the limitations to entry into the community.

- Improved safety. Crypto house owners should put up collateral beneath PoS. This retains individuals sincere, offering improved safety within the system.

Proof of stake cons

Regardless of stopping endlessly consuming computations, PoS comes with inevitable trade-offs and potential challenges, like:

- Community imbalance. The challenges of centralized networks beneath PoW are simpler to cope with, however, PoS continues to be subjected to wealth focus, giving dominance to these with important crypto tokens. This advantages early adopters and creates an imbalance.

- Preliminary distribution. PoS responsibly and pretty distributes the preliminary provide of cryptocurrency tokens. If a small group acquires an enormous portion of the preliminary provide, they get an unfair benefit as they will management the community.

- Unreliability. Beneath some networks, validators could change into inactive in the event that they lose curiosity over time. Whereas it is a uncommon incidence, it does have an effect on PoS’s dependability.

Do you know? A PoS community consumes lower than 0.001% vitality than a PoW community.

Proof of stake vs. proof of labor: how they work

PoS and PoW serve the identical objective for blockchain consensus, however their performance differentiates them.

Proof of stake

Whereas PoS does not require the computational energy required in PoW, it has its personal technical complexities important for community integrity and safety. PoS follows a set of consensus algorithms that outline validator choice, staking mechanisms, and reward distribution.

The choice algorithm beneath PoS takes into consideration the quantity of staked cryptocurrency and, to keep up equity, a randomization factor. Some extra standards, just like the age of cash and transaction historical past, are additionally thought of. To remain clear, PoS makes use of good contracts to implement the crypto staking guidelines, together with penalties for unhealthy actors.

All of those parts, together with many others, keep the safety, equity, and reliability of PoS networks.

Proof of labor

With regards to PoW, the selection of mining {hardware} performs a considerable function. The 2 widespread varieties are application-specific built-in circuits (ASICs) and graphics processing items (GPUs).

ASICs are custom-built specialised units that mine cryptocurrency utilizing the hashing algorithm of the PoW community. They’re energy-efficient, optimized for velocity, and made to outperform general-purpose {hardware} like GPUs. Nonetheless, ASICs create the issue of centralization as a result of members want monetary assets to buy and function them.

However, GPUs can be utilized for numerous computing duties along with crypto mining. Much less specialised than ASICs, however they provide increased flexibility resulting from a broad set of purposes. GPU mining is appropriate for cryptocurrencies immune to ASIC mining. There’s additionally CPU mining that’s related for such purposes.

FAQs: proof of labor vs. proof of stake

Nonetheless debating? Discover extra solutions to your queries under:

Q. Is proof of labor higher than proof of stake?

Each proof of labor and proof of stake have totally different advantages and challenges. PoW affords robust safety, however it’s not simply scalable and consumes excessive vitality. PoS is quicker and consumes much less vitality, however the safety depends upon the stake distribution between members.

Q. What are the disadvantages of proof of stake?

If a small group of stakeholders holds a majority of the staked cash, the PoS community is weak to assaults. PoS is a comparatively new know-how. Whereas it exhibits promise, its long-term safety wants extra time to match the monitor file established by proof of labor.

Q. How to decide on between proof of labor and proof of stake?

The selection between PoW and PoS depends upon the precise wants and priorities of the venture. Rigorously weigh the trade-offs between safety, scalability, vitality effectivity, and decentralization to make the very best resolution in your venture inside a blockchain community.

The consensus is in…

There’s no good system. The talk on proof of labor vs. proof of stake is ongoing and important to the blockchain and cryptocurrency neighborhood. Many multi-chain blockchain options meet totally different communities’ wants by providing the very best of each worlds.

Finally, scalability necessities, vitality concerns, and particular use instances direct the course. One factor that’s for certain is that each PoW and PoS are shaping the way forward for decentralized finance and digital belongings.

No matter what you select, all the time make investments properly. Try the newest cryptocurrency statistics to remain up to date on market developments.

This text was initially revealed in 2023. It has been up to date with new data.