The Society of Motor Producers and Merchants (SMMT) is asking for the Costly Automotive Complement to be scrapped for pricier battery electrical autos (BEVs) following a fourth month of decline within the new automobile market.

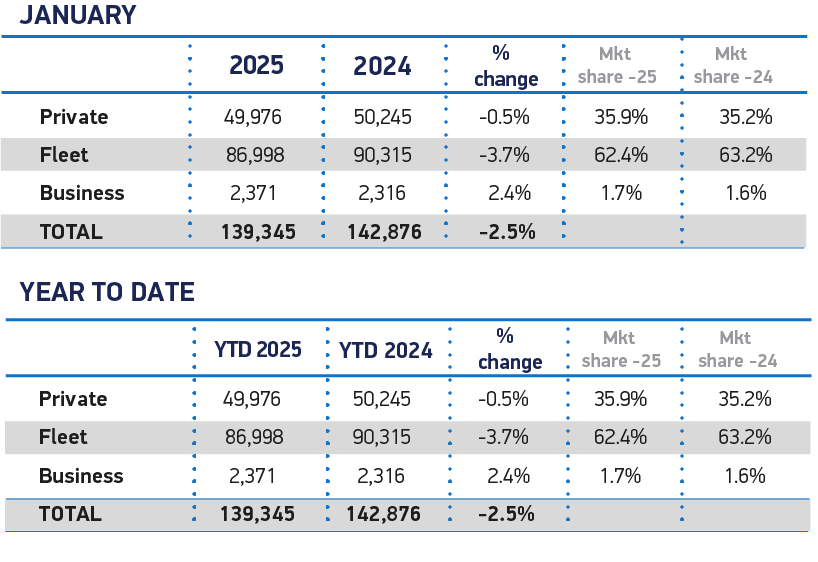

Weak client confidence and hard financial circumstances mixed to ship a 2.5% drop within the UK’s new automobile market to 139,345 models in January, in accordance with knowledge launched at present by the SMMT.

The SMMT mentioned the applying of the Automobile Excise Responsibility ‘Costly Automotive Complement’ (ECS) to BEVs in simply two months comes “on the worst time for the trade”.

It means EV fashions costing greater than £40,000 – which the SMMT mentioned represents the bulk available on the market, given larger manufacturing prices – will incur a £3,110 tax invoice over the primary six years of possession – in contrast with zero at current.

On a barely extra constructive be aware, the retail market solely noticed a drop of 0.5% in January, whereas the fleet market slowed significantly with a 3.7% drop in the identical month.

Enterprise registrations rose by 2.4% though, as a really small portion of the market, this translated to simply 55 extra models.

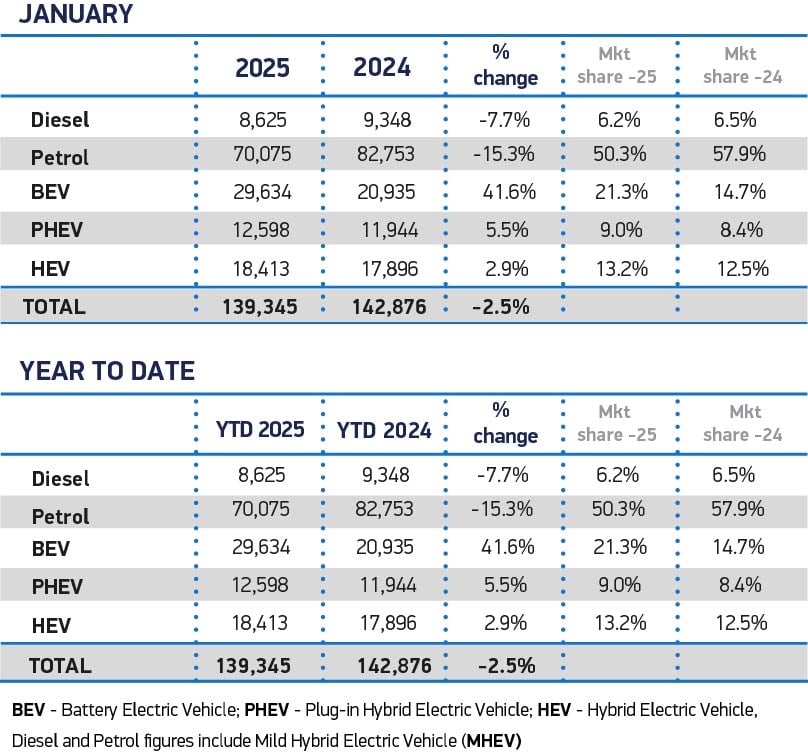

Reflecting a continuation of ongoing traits, petrol automobile registrations dropped by 15.3% to comprise simply over half (50.3%) the market, with diesel down 7.7% to assert a 6.2% share.

Each hybrid electrical autos (HEVs) and plug-in hybrids (PHEVs) recorded quantity progress and noticed their market shares rise to 13.2% and 9.0% respectively.

Battery electrical automobile (BEV) registrations, in the meantime, continued current progress traits, with volumes up by 41.6% year-on-year to take a 21.3% market share.

Regardless of the nice work carried out by vendor gross sales groups throughout the UK, BEV market share nonetheless stays wanting the 22% goal set by Authorities for final 12 months, and even additional behind the 28% requirement for 2025.

ZEV mandate assessment important

The SMMT mentioned the hole between demand and ambition is why the assessment of how the Zero Automobile Emissions mandate and the buying and selling scheme put in place for automobile manufacturers that do not meet targets is “important and should ship significant modifications urgently, else there’ll probably be vital adverse penalties for the market, trade and, doubtlessly, the buyer”.

The commerce physique mentioned personal retail patrons nonetheless lack a significant fiscal incentive to purchase an EV and, furthermore, the applying of the Automobile Excise Responsibility ‘Costly Automotive Complement’ (ECS) to BEVs in simply two months comes on the worst time for the trade.

It mentioned the change will influence each the brand new and used automobile markets, “undermining the objective of a mass market transition”.

Because of this, the trade is asking for tax plans to be revised to make sure the system is truthful and avoids dissuading those that wish to purchase an EV.

Mike Hawes, SMMT chief government, mentioned: “January’s figures present EV demand is rising – however not quick sufficient to ship on present ambitions.

Mike Hawes, SMMT chief government, mentioned: “January’s figures present EV demand is rising – however not quick sufficient to ship on present ambitions.

“Affordability stays a serious barrier to uptake, therefore the necessity for compelling measures to spice up demand, and never simply from producers.

“The appliance, due to this fact, of the ‘Costly Automotive Complement’ to VED on electrical autos is the improper measure on the improper time.

“Moderately than penalising EV patrons, we ought to be taking each step to encourage extra drivers to make the change, serving to meet authorities, trade and societal local weather change objectives.”

The SMMT mentioned the the brink for the ECS – dubbed the ‘luxurious automobile tax’ when launched – has remained unchanged at £40,000 because it was set eight years in the past, when the general market was 30% bigger than at present and BEVs barely featured.

EVs ought to be exempt from ECS

Hawes needs to at the very least see the value threshold for the ECS raised, or would like for EVs to be exempted from the ECS totally.

He mentioned: “With greater than twice as many BEVs registered this January than in the entire of 2017, elevating the eligibility threshold for EVs – or exempting them from the ECS totally – would ship the message that EVs are necessities, not luxuries, and guarantee automobile taxation stays truthful and acceptable for at present’s market circumstances.”

The most recent market outlook anticipates the brand new automobile market declining barely in 2025 by 0.2% to 1.95 million models, with BEV uptake rising by 20.9% to 462,000 – a 23.7% market share, however nonetheless wanting the mandated 28% goal for the 12 months.

The hole is anticipated to widen in 2026, when BEVs are anticipated to comprise 28.3% in opposition to a goal of 33%. The rising disparity between market demand and controlled targets additional underscores the necessity for substantive market incentives that match ambition.

UK sellers have a pessimistic outlook for 2025

Sue Robinson, chief government of the Nationwide Franchised Sellers Affiliation (NFDA) mentioned the organisation’s 2025 Outlook Survey exhibits sellers are involved with the outlook for 2025, with 71% choosing ‘pessimistic’ in response to how they view the general buying and selling surroundings for the 12 months forward, whereas 29% have been ‘barely optimistic.’

Robinson mentioned: “Additionally within the survey, sellers highlighted the necessity for Authorities assist, together with incentives corresponding to grants and investments in charging infrastructure.

“In addition they confused the continued advantages of hybrids past 2030.

“These will probably be highlighted in NFDA’s response to the phase-out date/ZEV mandate session this month.”

Robinson mentioned this 12 months is anticipated to carry notable modifications for automotive sellers, together with a rise in Employers’ Nationwide Insurance coverage contributions from 13.8% to fifteen% and the introduction of VED on EVs.

She added: “The UK automotive sector is a crucial sector within the UK and traditionally NFDA members have been very versatile and resilient to headwinds.”

Jamie Hamilton, automotive companion and head of electrical autos at Deloitte, mentioned that with out clearer trade assist, a completely electrical future dangers stalling on the highway.

He mentioned: “Deloitte analysis exhibits a powerful majority (80%) of UK shoppers who intend to buy an electrical automobile plan to cost their automobile at dwelling, in comparison with different choices corresponding to public charging stations (10%) or at work (11%).

“Whereas handy for some, this highlights a big barrier to EV adoption for these with no driveway.

“A sturdy and dependable public charging community is crucial to present all drivers the arrogance to make the change.”

The Authorities’s reported plans to introduce subsidies for EV client loans may present a much-needed enhance to the personal market.

Hamilton mentioned: “Making EVs extra financially accessible is essential to driving mass adoption and attaining web zero ambitions.

“Nevertheless, this should be a part of a broader technique that gives producers readability on 2030 Zero Emission Automobile targets and addresses the wants of all drivers, together with funding in public charging infrastructure.”