Join Chalkbeat’s free weekly e-newsletter to maintain up with how training is altering throughout the U.S.

Christian Rojas Linares can’t end his monetary support varieties as a result of he’s been blanketed with error messages. The New York Metropolis highschool senior has even obtained incorrect emails telling him his utility was canceled.

In Philadelphia, Yasmeen Mutan had higher luck: Ending the shape solely took her an hour. However the federal authorities has been so sluggish to course of and share her information that, 4 months later, she nonetheless doesn’t know the way a lot she’ll get in monetary support. With out that, she will be able to’t determine the place to go to school. And which means she will be able to’t apply for state monetary support both.

“I’m logging in each couple of days, simply to ensure I didn’t miss out on something,” Mutan mentioned. “I simply don’t know what to do.”

With school determination deadlines looming, hundreds of highschool seniors have been caught in limbo as a result of bungled rollout of the brand new Free Utility for Federal Pupil Assist. The so-called Higher FAFSA was alleged to make it easier for college students to obtain monetary support. But the errors have been quite a few and severe sufficient that prime faculty counselors and advocates for school entry now concern that promising college students from the Class of 2024 will find yourself not going to school in any respect.

As of late March, simply over a 3rd of highschool seniors had efficiently submitted the FAFSA, in keeping with information tracked by the Nationwide Faculty Attainment Community. In earlier years, practically half of seniors would have performed so by now. College students who full the FAFSA are much more more likely to go to school, so the low completion charges increase considerations concerning the long-term affect on this 12 months’s graduating class.

And the decline tracked by the community is far higher at faculties serving quite a lot of college students from low-income backgrounds and college students of shade.

Closing off routes to monetary support creates “monumental points,” mentioned CJ Powell, director of advocacy for the Nationwide Affiliation for Faculty Admission Counseling, particularly for college students whose households have fewer sources. These college students, usually college students of shade and kids of immigrants, are particularly reliant on Pell grants and different support to afford school. And after they delay school, Powell mentioned, they’re much less more likely to go in any respect.

“That individuals will stroll away is holding me up at night time,” mentioned Invoice Wozniak, vp for communications and pupil companies with INvestED, a nonprofit that promotes postsecondary training in Indiana. “The people who find themselves most weak they usually do the whole lot proper and it’s not working, I do fear about that.”

Cascade of issues with new FAFSA kind

It wasn’t alleged to be this fashion.

Change into a Chalkbeat sponsor

Finishing the FAFSA is the gateway to grants, scholarships, and backed loans that make school inexpensive for hundreds of thousands of scholars. However for years, college students and fogeys discovered the shape to be sophisticated and aggravating.

In 2020, Congress handed laws to simplify the shape, with far fewer questions and extra household monetary info pulled immediately from tax returns that the federal authorities already has. However the transition proved to be much more technically tough than anticipated and fell to a U.S. Division of Schooling that was additionally tasked with overseeing sophisticated pupil debt forgiveness applications, in keeping with quite a few stories.

The launch of the brand new kind was delayed, and when it lastly got here on-line in late December, it was riddled with technical glitches.

College students from combined standing households, during which one or each mother and father don’t have a Social Safety quantity, confronted among the largest hurdles. Workarounds that these college students have used for years, corresponding to coming into all zeros rather than a Social Safety quantity, now not labored. And for weeks there was no approach for these college students — most of them U.S. residents — so as to add their mother and father’ monetary info.

In March, the training division introduced that the issue was fastened. However many college students are nonetheless encountering issues even trying to confirm their mother and father’ identities.

That’s the case for a a number of of Danielle Insel’s college students on the City Meeting Institute of Math and Science for Younger Ladies in Brooklyn. They’re “nonetheless going forwards and backwards with simply getting their mum or dad’s id acknowledged to allow them to end the mum or dad part of the FAFSA,” mentioned Insel, the college’s director of postsecondary readiness.

“After 5, six, eight makes an attempt, they wish to hand over,” she mentioned. College students are already telling her, generally jokingly, and generally much less so: “I’m not going to school, I’m not going to get monetary support.”

“It’s demoralizing, irritating, and sure, I can see it having a direct hyperlink to a lower in enrollment. If not enrollment, then positively matriculation,” she added.

In group chats and on message boards, school advisers commerce ideas for getting college students previous technical hurdles. At instances they’ll sound like a retro gaming cheat code.

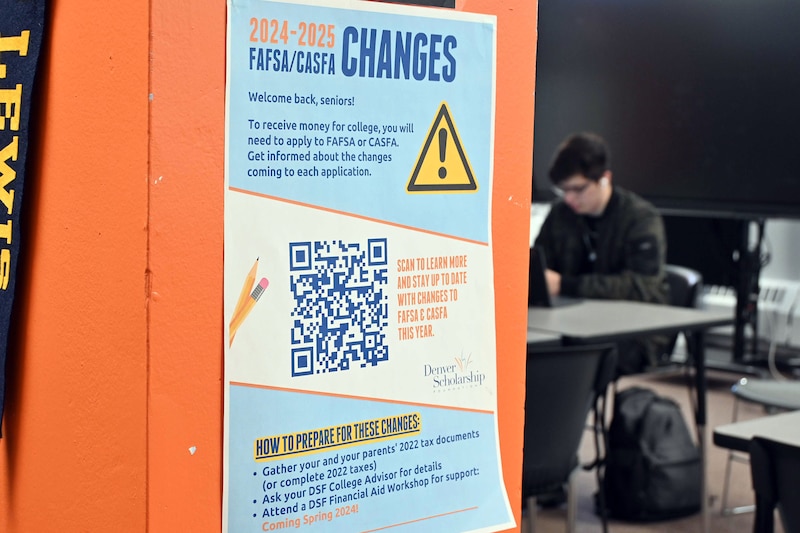

On a latest afternoon at Denver’s West Excessive Faculty, Denver Scholarship Basis school adviser Federico Rangel shared a hack with pupil Rene Torres, who was getting an error message each time he tried so as to add his mother and father to his account, a obligatory step.

Change into a Chalkbeat sponsor

“You press the backspace button twice,” Rangel mentioned to Torres. “It ought to take us again to the unique web page after which we will transfer ahead. It then ought to enable us to make the account.”

At first, the trick didn’t work, however then Torres acquired a brand new display screen for the primary time.

“Oh,” Rangel mentioned. “You bought the id verification web page.”

“It’s a step in the fitting course.”

Many college students don’t have monetary support packages

The federal training division has additionally been sluggish to share pupil information with universities and lately introduced it will be reprocessing many varieties to right discrepancies in tax information. The Chronicle of Greater Schooling reported that school monetary support officers are encountering quite a lot of errors, resulting in extra delays and frustrations. Schools don’t wish to ship out monetary support packages that they later have to vary.

In a typical 12 months, college students would get monetary support packages alongside school acceptance letters and would have weeks or months to check provides and weigh their choices. This 12 months, college students have acceptance letters from schools however most often no monetary support awards.

“College students determine the place to go and whether or not to go on the backs of those award letters,” mentioned Invoice DeBaun, the Nationwide Faculty Attainment Community’s senior director for information and strategic initiatives. “You’re taking a look at these varied pathways with no concept which of them are accessible to you.”

For counselors, this implies they’re nonetheless working with seniors as an alternative of beginning to work with juniors on their school essays like they usually would. It’s tougher to carry in-person “full the FAFSA” occasions when households may simply go away pissed off. And holding monitor of shifting deadlines has change into its personal headache.

For college kids, not having the ability to determine on a school can delay or complicate different choices.

Mark Stulberg, director of faculty counseling at Newark’s Lincoln Park Excessive Faculty, mentioned college students’ makes an attempt to line up housing, internships, and different features of faculty life for subsequent 12 months are all “type of on pause proper now.”

Change into a Chalkbeat sponsor

Lincoln Park is a part of the North Star Academy Constitution Faculty system, the place most college students are Black and from low-income households. The colleges emphasize college-going beginning in kindergarten.

This 12 months, 85% of scholars have accomplished the FAFSA, a charge far above the state common however nonetheless 5 to 10 share factors decrease than in a typical 12 months for North Star.

Stulberg mentioned lecturers and counselors are doing the whole lot they’ll to encourage college students to have endurance and see the delays as a comparatively small bump in a protracted journey. Up to now, households are sticking with the method.

But he’s apprehensive a few of his college students “could have put within the final 10 to 12 years price of labor to arrange themselves to achieve success in school” solely to decide on one other path that received’t set them up for achievement like larger training can.

Counselors inform college students: deal with long-term targets

Wozniak in Indiana mentioned his staff of faculty advisers, who employees hotlines and occasions, need mother and father and college students to know they’re not alone, and it’s not their fault. Many schools and state monetary support programs are pushing again deadlines to accommodate the delays, and monetary support provides will come.

Powell mentioned counselors will help college students apply for different scholarships whereas they’re ready, or go over find out how to learn a monetary support provide to allow them to examine choices in a shortened time-frame.

Rojas Linares is attempting to stay upbeat. He has been accepted to plenty of private and non-private universities, although he’s in limbo till he can discover out his Pell grants, work examine, federal loans, and his award by way of the New York State Tuition Help Program.

“How for much longer do we now have to attend to get the outcomes of monetary support?” Rojas Linares questioned. “I’m simply hoping this may all be over so we don’t must stress about it any extra.”

Mutan is decided to go to school however could find yourself ready a 12 months if she doesn’t get monetary support info quickly, she mentioned. Her mother and father are Palestinian immigrants who principally converse Arabic, and her father gives the family’s solely revenue. She doesn’t wish to put monetary strain on her mother and father, and she or he doesn’t wish to tackle debt.

“I need to have the ability to put myself by way of school, and FAFSA is an enormous a part of that,” she mentioned.

Chalkbeat journalists Amy Zimmer and Michael Elsen-Rooney in New York, Catherine Carrera in Newark, Carly Sitrin in Philadelphia, and Jason Gonzales in Colorado contributed reporting.

Erica Meltzer is Chalkbeat’s nationwide editor based mostly in Colorado. Contact Erica at emeltzer@chalkbeat.org.