By Julie Knakal, Government Director, Information and Content material

Administration, and Alex Vinatoru, Senior Information Analyst, S&P World

Mobility

What OEMs, Sellers and Lenders Have to Know

As we method the primary half of 2025 (H1 2025), a seismic shift

is looming over the automotive market. We count on auto lease returns

to plummet in comparison with the earlier 12 months, probably wiping out a

vital variety of models from the trade.

The stress is on for sellers and automotive lenders, however with

the proper methods, there's a silver lining. Learn on to find

what's driving these modifications within the auto lease market, why it

issues and the way your enterprise can flip this problem into an

alternative.

A Main Drop in Auto Lease Returns: What the Information

Reveals

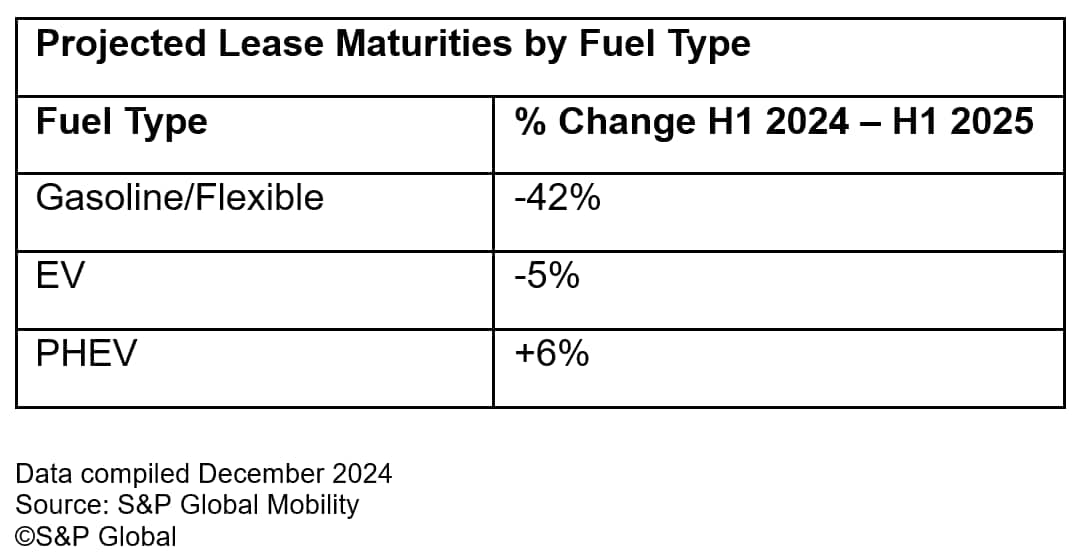

In H1 2025, we challenge lease maturities to fall by 41% in contrast

to the identical interval in 2024. This vital decline may

translate into a success of almost 1 million autos to the

trade.

The premium market will take the toughest hit, with an anticipated

46% drop in auto lease returns. We count on mainstream segments to

expertise a decline of 39%. Most main automobile manufacturers will see

decreases, however the vary is vast—from a modest 11% drop to a

staggering 81% discount in auto lease returns for some main

gamers.

Why Shoppers Are Shifting from Auto Leasing to Auto

Financing

The explanations behind this shift largely stem from a change in

shopper habits in response to the market circumstances two to 3

years in the past.

There are a number of key components that influenced these selections:

- Stock shortages and pricing: The first

lease time period driving this decline is 36 months, so we have to

think about what was taking place in 2022. Low stock in H1 2022

pushed OEMs and lenders to scale back their buyer and supplier

incentives, with the most important affect on leases. This contributed to

a mean 10% rise in lease funds as a share of MSRP from

2019 to 2022. However, finance funds as a share

of MSRP held regular. Partly due to this differential,

returning lessees in H1 2022 who opted to interchange their outgoing

leases usually selected to finance their new autos as an alternative. - Longer mortgage phrases: In H1 2022, the share of

lessees who returned to the brand new automobile market and leased a brand new

automobile was 64%—an eight percentage-point drop from H1 2020 and

H1 2021. Thirty p.c of lessees who returned to the market in H1

2022 financed their new automobile—up from the standard 24% share.

Of lessees who got here out of a 36-month lease and selected to finance

as an alternative, many opted for longer mortgage phrases: Whereas 22.5% selected a

60-month mortgage, 45.2% opted for the longer phrases of 72-months and

17.6% for 84-month phrases.

Steps the Trade Can Take to Encourage Auto Leasing

inH1 2025

The problem in H1 2025 stays: how will we get customers to

change again to auto leasing? The excellent news is that the trade has

levers to tug, and lease funds as a share of MSRP dropped

in 2024.

- Regulate incentives: OEMs and lenders will want

to get inventive to encourage returning lessees to go for leases

once more. Rising incentives, notably within the premium section,

can be key to creating leases extra interesting because the market

shifts. - Goal particular states: Greater than 50% of

projected lease maturities are concentrated in simply 5 states,

starting from a 24% drop in returns in Michigan to a 49% drop in

California. Tailoring methods to those states may assist sellers

and lenders higher handle the decline in lease maturities. - Seize customers who favor auto leasing: Many

customers want to lease as a result of it permits them to drive a brand new

automobile each few years, making certain they keep inside guarantee and

benefit from the newest know-how. Sellers and lenders ought to goal

these prospects to make sure they continue to be loyal to leasing.

Wanting Past 2025: A Path Towards

Stability

Though the challenges of H1 2025 can be vital, there’s

gentle on the finish of the tunnel. By H1 2026, the market ought to start

to stabilize, and we must always see extra significant enchancment in H1

2027, with auto lease return progress as a consequence of a 21% improve in

36-month lease quantity in H1 2024.

That progress may improve to roughly 30 p.c if latest

developments in lease quantity proceed, as 24-month leases that exit the

door in H1 2025 will start returning in H1 2027. There may be potential

for extra upside in H1 2027 and H1 2028 if OEMs can

efficiently convert prospects who’ve switched to financing again

into leasing. Even so, we count on complete lease maturities in future

years to stay effectively under the upper ranges seen from 2021 to

2024.

How Sellers and Lenders Can Put together

- Promote lease return packages: To mitigate the

affect of declining auto lease returns, sellers and lenders have to

actively promote their lease return packages. This contains

reaching out to customers earlier than their leases are up and offering

them with clear incentives to lease once more. - Concentrate on buyer training: Many customers

will not be totally conscious of their fairness place or the advantages of

leasing. Sellers ought to give attention to educating their prospects about

the worth of auto leasing and the way it aligns with their wants for

decrease funds, newer autos and guarantee protection. - Leverage knowledge to focus on potential lessees:

Information analytics can be important to establish lessees who’re most

more likely to return to the leasing market. Sellers can use this knowledge

to focus on their outreach efforts and create tailor-made gives that

attraction to those potential prospects. - Supply inventive financing and auto lease

choices: As automobile costs stay excessive, providing versatile

financing and leasing choices could possibly be essential to persuade

customers to stay with or return to leasing. Packages that make

funds extra manageable, like deferred funds or trade-in

packages, can be important.

Conclusion

The primary half of 2025 presents not solely a big problem

for automotive sellers and automotive lenders but in addition a chance to

adapt to altering shopper habits. By understanding the components

driving the decline in auto lease returns and taking proactive

steps to draw lessees again to the market, dealerships and

lenders can place themselves for fulfillment because the market begins

its restoration within the coming years.

AutoCreditInsight – provided in partnership with TransUnion –

gives clients24/7 entry to new automobile data and

aggregated return-to-market volumes by monthwith

depersonalized mortgage and credit score data.

Be taught Extra About AutoCreditInsight

Market Scan givesOEMs with quick, aggressive

fee evaluation throughout autos, serving to you to optimize your

incentives and gross sales methods to match your competitors.