By Julie Knakal, Govt Director, Information and Content material

Administration, and Alex Vinatrou, Senior Information Analyst, S&P International

Mobility

As we method the primary half of 2025 (H1 2025), a seismic shift

is looming over the automotive market. We count on auto lease returns

to plummet in comparison with the earlier yr, doubtlessly wiping out a

important variety of models from the business.

The strain is on for sellers and automotive lenders, however with

the appropriate methods, there's a silver lining. Learn on to find

what's driving these modifications, why it issues and the way what you are promoting

can flip this problem into a chance.

A Main Drop in Auto Lease Returns: What the Information

Exhibits

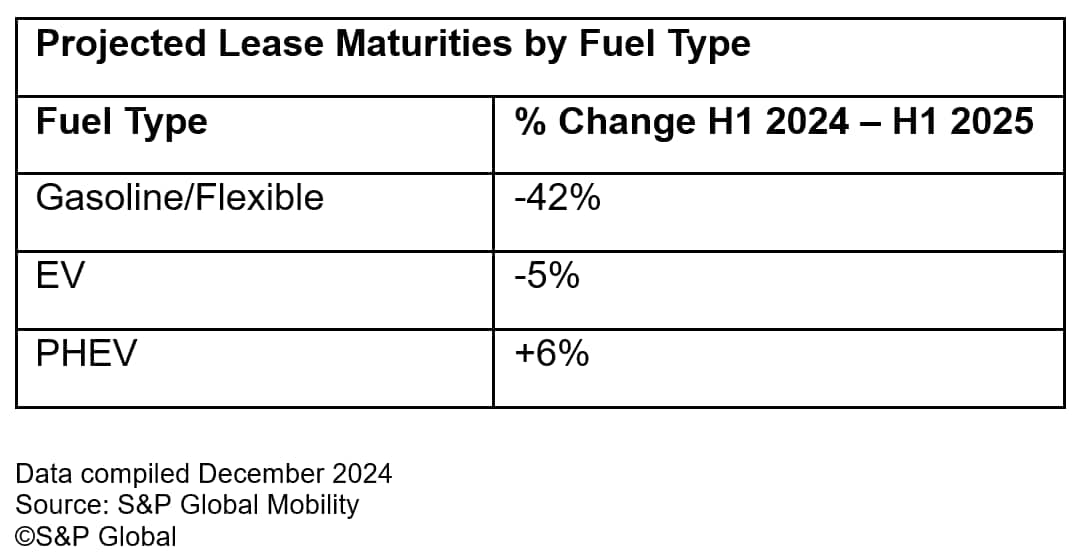

In H1 2025, we challenge lease maturities to fall by 41% in contrast

to the identical interval in 2024. This important decline may

translate into successful of almost 1 million automobiles to the

business.

The premium market will take the toughest hit, with an anticipated

46% drop in lease returns. We count on mainstream segments to

expertise a decline of 39%. Most main car manufacturers will see

decreases, however the vary is extensive—from a modest 11% drop to a

staggering 81% discount in lease returns for some main

gamers.

What’s Inflicting the Decline in Projected Auto Lease

Returns?

The explanations behind this shift largely stem from a change in

client conduct in response to the market circumstances two to a few

years in the past.

There are a number of key elements that influenced these selections:

- Stock shortages and pricing: The first

lease time period driving this decline is 36 months, so we have to

contemplate what was occurring in 2022. Low stock in H1 2022

pushed OEMs and lenders to cut back their buyer and seller

incentives, with the most important influence on leases. This contributed to

a mean 10% rise in lease funds as a proportion of MSRP from

2019 to 2022. Then again, finance funds as a proportion

of MSRP held regular. Partially due to this differential,

returning lessees in H1 2022 who opted to interchange their outgoing

leases usually selected to finance their new automobiles as an alternative. - Longer mortgage phrases: In H1 2022, the share of

lessees who returned to the brand new car market and leased a brand new

car was 64%—an eight percentage-point drop from H1 2020 and

H1 2021. Thirty % of lessees who returned to the market in H1

2022 financed their new car—up from the everyday 24% share.

Of lessees who got here out of a 36-month lease and selected to finance

as an alternative, many opted for longer mortgage phrases: Whereas 22.5% selected a

60-month mortgage, 45.2% opted for the longer phrases of 72-months and

17.6% for 84-month phrases.

Steps the Business Can Take to Encourage Leasing

inH1 2025

The problem in H1 2025 stays: how will we get shoppers to

change again to leasing? The excellent news is that the business has

levers to drag, and lease funds as a proportion of MSRP dropped

in 2024.

- Modify incentives: OEMs and lenders will want

to get inventive to encourage returning lessees to go for leases

once more. Rising incentives, significantly within the premium section,

will probably be key to creating leases extra interesting because the market

shifts. - Goal particular states: Greater than 50% of

projected lease maturities are concentrated in simply 5 states,

starting from a 24% drop in returns in Michigan to a 49% drop in

California. Tailoring methods to those states may assist sellers

and lenders higher handle the decline in lease maturities. - Seize shoppers who favor leasing: Many

shoppers choose to lease as a result of it permits them to drive a brand new

car each few years, guaranteeing they keep inside guarantee and

benefit from the newest know-how. Sellers and lenders ought to goal

these clients to make sure they continue to be loyal to leasing.

Wanting Past 2025: A Path Towards

Stability

Though the challenges of H1 2025 will probably be important, there’s

gentle on the finish of the tunnel. By H1 2026, the market ought to start

to stabilize, and we must always see extra significant enchancment in H1

2027, with progress attributable to a 21% enhance in 36-month lease quantity in

H1 2024.

That progress may enhance to roughly 30 % if current

tendencies in lease quantity proceed, as 24-month leases that exit the

door in H1 2025 will start returning in H1 2027. There’s potential

for extra upside in H1 2027 and H1 2028 if OEMs can

efficiently convert clients who’ve switched to financing again

into leasing. Even so, we count on complete lease maturities in future

years to stay nicely under the upper ranges seen from 2021 to

2024.

How Sellers and Lenders Can Put together

- Promote lease return packages: To mitigate the

influence of declining lease returns, sellers and lenders have to

actively promote their lease return packages. This consists of

reaching out to shoppers earlier than their leases are up and offering

them with clear incentives to lease once more. - Give attention to buyer schooling: Many shoppers

will not be absolutely conscious of their fairness place or the advantages of

leasing. Sellers ought to deal with educating their clients about

the worth of leasing and the way it aligns with their wants for decrease

funds, newer automobiles and guarantee protection. - Leverage information to focus on potential lessees:

Information analytics will probably be important to establish lessees who’re most

prone to return to the leasing market. Sellers can use this information

to focus on their outreach efforts and create tailor-made provides that

enchantment to those potential clients. - Supply inventive financing and leasing choices:

As car costs stay excessive, providing versatile financing and

leasing choices may very well be essential to persuade shoppers to stay

with or return to leasing. Packages that make funds extra

manageable, like deferred funds or trade-in packages, will probably be

important.

Conclusion

The primary half of 2025 presents not solely a big problem

for automotive sellers and automotive lenders but additionally a chance to

adapt to altering client conduct. By understanding the elements

driving the decline in lease returns and taking proactive steps to

entice lessees again to the market, dealerships and lenders can

place themselves for fulfillment because the market begins its restoration

within the coming years.

AutoCreditInsight – supplied in partnership with TransUnion –

gives shoppers24/7 entry to car registrations and

return-to-market volumes by month with depersonalized mortgage and

credit score info.

Be taught Extra About AutoCreditInsight

Market Scan givesOEMs with quick, aggressive

cost evaluation throughout automobiles, serving to you to optimize your

incentives and gross sales methods to match your competitors.