In a coordinated push by means of federal businesses, the Biden administration on Friday launched a revised set of laws making use of to the EV tax credit score that may finally make the credit score simpler to assert for a wider vary of automobiles in 2025 and 2026 however no simpler for Chinese language corporations to achieve a foothold in the marketplace.

The information got here in up to date guidelines posted Friday by the U.S. Division of Power (DOE), the Division of Transportation (DOT), and the Inside Income Service (IRS), every regarding their respective areas in defining and imposing the credit score guidelines as laid out by the 2022 Inflation Restoration Act.

Easing up on essential minerals till 2027

The excellent news for automakers, and particularly for battery and associated element crops in North America, is that after Friday’s clarifications they’ve two additional years to adjust to way more stringent necessities on the origin of battery minerals.

EV tax credit score necessities – 5/2024 revisions

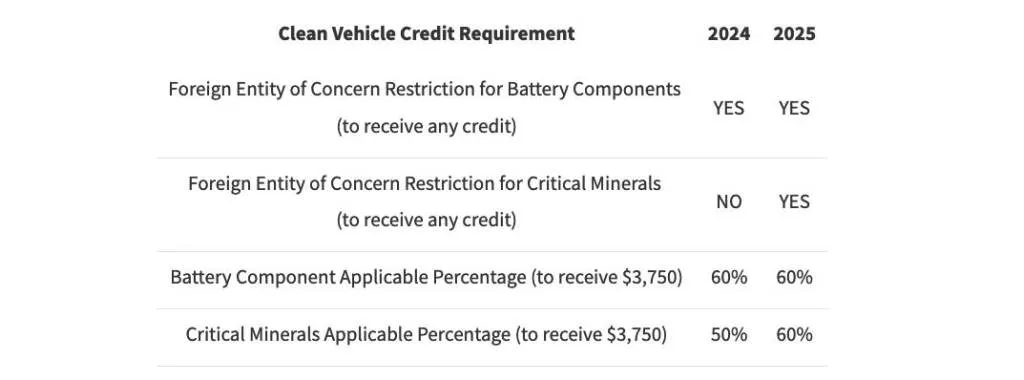

Below the unique IRA framework, EVs received’t qualify for the total EV tax credit score in 2024 with out 60% of their battery components originating within the U.S., and with out no less than 50% of their essential battery supplies mined or processed within the U.S. or a popular commerce associate corresponding to Japan, South Korea, or the European Union.

These necessities had been set to turn out to be even stricter in 2025 with even tighter limitations on the origin of battery supplies; automobiles with any supply minerals from China or different designated International Entities of Concern can be disqualified. However beneath Friday’s laws, corporations have till 2027 to conform, permitting automakers and provide corporations to get extra severe about how they observe their provide chains between at times.

2024 Kia EV9

“At present’s actions from Treasury and DOE present readability and certainty to an EV market that’s quickly rising,” mentioned John Podesta, the senior advisor to the President for Worldwide Local weather Coverage, in a Biden administration abstract assertion. “The path we’re headed is evident—towards a future the place many extra People drive an EV or a plug-in hybrid and the place these automobiles are inexpensive and made right here in America.”

Secretary of Treasury Janet Yellen, in a launch on the ultimate guidelines, additionally identified that in Tennessee, North Carolina, and Kentucky “how ecosystems have developed in communities nationwide to onshore your entire clear car provide chain so the US can lead within the subject of inexperienced vitality.”

Current credit score necessities stay

The Treasury Division and Inside Income Service clearly laid out which parts car makers might want to adjust to in 2025 versus 2024. At current, automobiles earn a most of $7,500 if assembled in North America, whereas half of that full quantity pertains to essential minerals and half of it pertains to battery parts.

The tax credit score solely applies to these with a modified adjusted gross revenue limitation of $300,000 for married {couples} submitting collectively, $225,000 for head of family, and $150,000 for different filers, and the IRA tax-credit guidelines set value limits of $55,000 for brand new vehicles and $80,000 for brand new vehicles, SUVs, and vans.

2024 Ford F-150 Lightning Flash

Current guidelines have left a comparatively small portion of automobiles that qualify for the total $7,500 credit score quantity. For 2024, the credit score additionally grew to become an prompt rebate on the dealership, though not all dealerships have registered with the IRS to make that accessible.

The brand new guidelines revealed Friday additionally backstop this system with “integrity measures,” requiring an upfront evaluate of compliance “to make sure that certified producers are precisely representing their battery contents” so taxpayers received’t be penalized if automobiles are discovered to be nonconforming.

The brand new guidelines embody upfitters within the definition of a producer—an particularly necessary consideration for business automobiles aiming to assert the associated 45W credit score.

2025 Polestar 3

Any simpler for China to get in on EVs or provide chain?

So-called International Entity of Concern (FEOC) necessities written into the ruleset have been a severe concern for corporations with partial or full Chinese language possession that goal to arrange store in North America for the EV provide chain or EV meeting.

Remarks throughout the revised guidelines place jurisdiction on the DOE for figuring out whether or not or not an organization complies. In accordance with the DOE, which additionally launched refined guidelines on International Entity of Concern restrictions, its 25% threshold on voting rights, fairness pursuits, and board seats of an organization searching for to assert the tax profit would every be evaluated independently and certified by the company.

Given the current fairness stake of China’s Geely in Polestar, which may render it disqualified for the total credit score over the long run, regardless that it plans to assemble automobiles within the U.S. It could additionally imply {that a} host of Chinese language suppliers which have already constructed crops within the U.S. for different elements of the auto provide chain, searching for to get in on the EV provide chain, wouldn’t be eligible. So of all these businesses, the DOE might have essentially the most vital, and globally political, function of all in following the cash.